Small and medium-sized enterprises (SMEs) form the backbone of India’s economy, playing a vital role in job creation and GDP growth. Yet, many still struggle to access timely and affordable credit. The future of SME lending in India is being shaped by technology, innovation, and new-age financial platforms like Growmax Fintech, which are making funding faster, more flexible, and more transparent. By bridging the gap between lenders and SMEs, these solutions are unlocking growth potential that was once out of reach.

Why access to credit matters for SMEs

For SMEs, working capital is the lifeblood of daily operations. Whether it’s purchasing raw materials, paying suppliers, or investing in new equipment, cash flow determines the pace of growth. Traditional lending methods often involve lengthy documentation, collateral demands, and slow disbursement timelines. These delays can cause missed opportunities and financial strain.

In contrast, fintech-driven solutions prioritize speed, flexibility, and risk management. By leveraging data analytics and alternative credit scoring models, lenders can now assess borrower credibility more accurately and disburse funds in record time.

Technology’s role in The future of SME lending in India

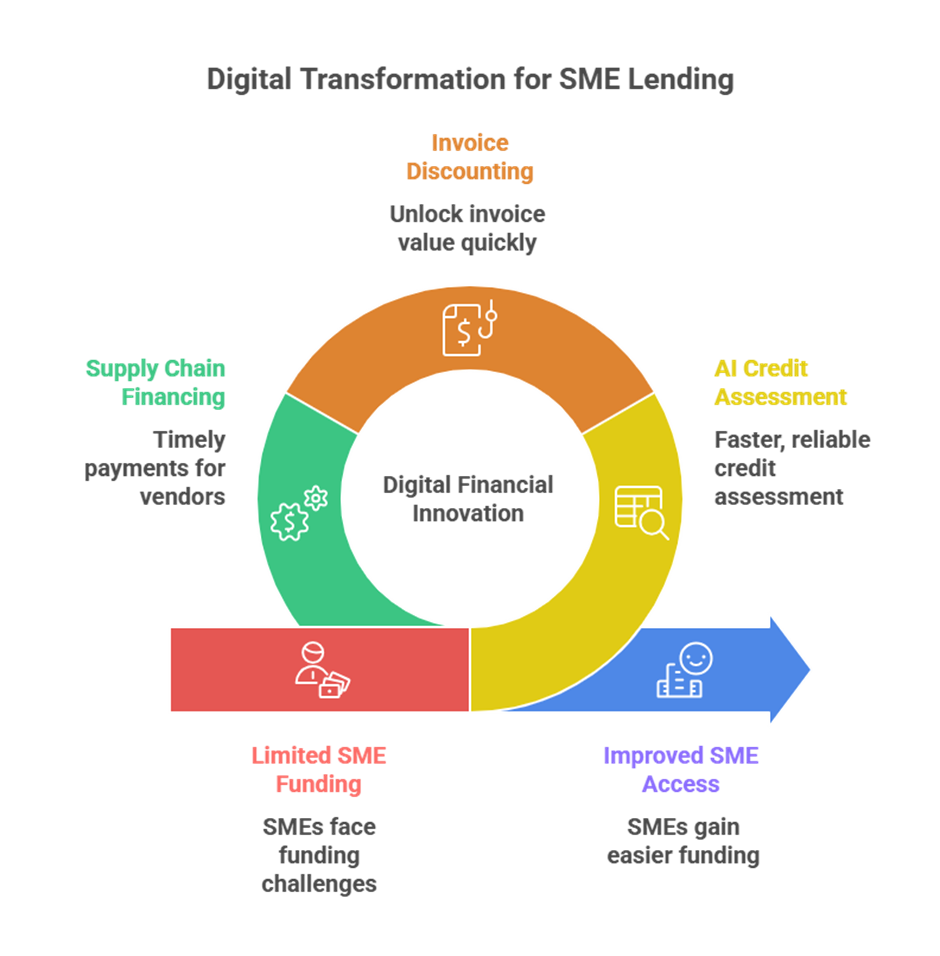

The digital transformation of the financial sector has opened up new possibilities for SME funding. With the rise of AI, blockchain, and digital KYC, credit assessment is faster and more reliable. Fintech platforms use predictive analytics to identify trustworthy borrowers while reducing default risk.

Through invoice discounting platforms, SMEs can unlock as much as 90% of their invoice value within 24–48 hours. Supply chain financing ensures that vendors and distributors receive timely payments without disrupting the buyer’s liquidity. These innovations not only improve access to funds but also strengthen business relationships.

How Growmax Fintech is redefining SME financing

Growmax Fintech stands out by offering tailored credit solutions designed to meet the unique needs of SMEs and MSMEs. Its product range includes invoice discounting, supply chain finance, working capital loans, and export financing. What makes it different is its ability to combine speed, flexibility, and risk protection.

By collaborating with multiple funders, Growmax Fintech delivers competitive rates and quicker approvals.

Its platform integrates compliance measures like KYC and AML checks, giving both lenders and borrowers peace of mind. For exporters, it also offers collection support and unsecured funding in international currencies.

Key benefits SMEs can expect

Faster funding

Businesses can access funds within 48 hours, eliminating delays that hinder growth.

No collateral hassle

Many products are unsecured, removing one of the biggest barriers to traditional lending.

Credit protection

Optional insurance safeguards against buyer defaults.

End-to-End support

From documentation to disbursement, the process is seamless and transparent.

The road ahead

As India’s SME sector continues to expand, the demand for innovative lending will only grow. Platforms like Growmax Fintech are proving that credit can be both accessible and secure. The government’s push for digital adoption, combined with private-sector innovation, is creating an ecosystem where SMEs can thrive.

The future of SME lending in India lies in building trust, embracing technology, and offering products that are as dynamic as the businesses they serve. By focusing on speed, risk management, and personalized solutions, lenders can empower SMEs to compete globally and achieve long-term success.

Shaping tomorrow’s SME finance

The coming years will see SME lending in India transform into a faster, smarter, and more inclusive system. With companies like Growmax Fintech leading the charge, access to credit will no longer be a bottleneck but a catalyst for growth. For SMEs willing to embrace these opportunities, The future of SME lending in India looks promising — and well within reach.