Small firms often face cash gaps. They need quick funds to run daily tasks. Many owners ask what gives steady money support. They also want to know the Best Choice for Small Business Cash Flow during tight weeks.

What Is Receivables Financing?

Receivables financing lets you get money from unpaid invoices. It helps you use money that is already yours.

How it works:

- You give your invoice to a finance partner.

- They release most of the money at once.

- You get the rest when the buyer pays.

Why firms like it:

- It gives fast access to cash.

- It does not add heavy debt.

- It helps you run your work without stress.

Receivables financing fits firms with slow-paying clients. It keeps the money cycle smooth and clear.

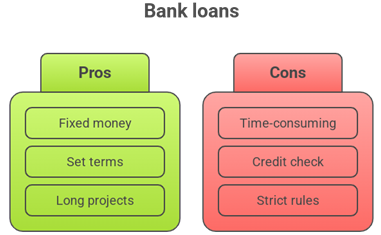

How Bank Loans Support Small Firms

Bank loans are a known way to get funds. Many owners use them for big plans or long needs.

What bank loans offer:

- Fixed money for a clear need

- Set interest and set time to repay

- Good for long projects

What to note:

- Approval takes more time

- Banks check credit history

- Heavy rules may slow the process

Bank loans work when you have time to plan and strong papers to support your request.

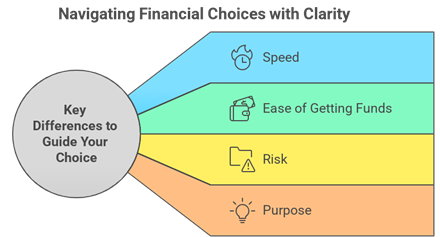

Key Differences to Guide Your Choice

This part helps you decide the Best Choice for Small Business Cash Flow based on your present need.

Speed:

- Receivables financing gives fast cash.

- Bank loans take longer to approve.

Ease of getting funds:

- Receivables financing depends on your invoice.

- Bank loans depend on your credit score and past records.

Risk:

- Receivables financing has lower risk.

- Bank loans add long-term debt.

Purpose:

- Use receivables financing for daily cash gaps.

- Use bank loans for large and planned needs.

Pick based on how fast you need the money and how stable your cash cycle is.

Which Option Helps You Run Your Firm Better?

Think about your daily flow. Think about how soon you need money. This point shapes the real Best Choice for Small Business Cash Flow in the middle of your journey.

Choose receivables financing if:

- Clients pay late often

- You need quick cash

- You want no extra debt

Choose bank loans if:

- You have a big plan

- You want fixed rules

- You can wait for approval

Both options help in different ways. The right pick supports steady growth

“Make the right move today. Pick the option that gives you steady cash and helps your business stay strong”