India is moving toward cleaner trade. Many exporters now look for fair credit and safe funds. This shift brings new hope. It also brings new tools. One key idea is Green Finance in Global Trade, which links money with low-impact export plans. It helps Indian exporters grow while cutting harm to nature.

Why Green Funding Matters

India sends many products to other countries. Buyers now ask for clean sources and low waste. Exporters must show proof of care.

They must also cut energy use and fix old systems. To meet these needs, they need steady and fair money support.

This is where Green Finance in Global Trade plays a key role.

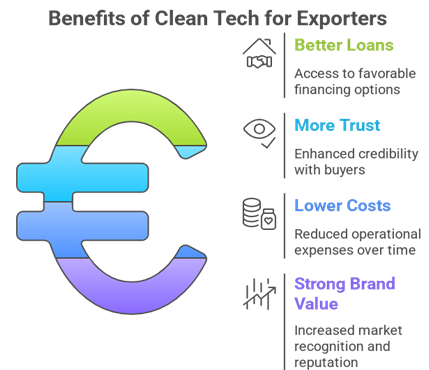

What it means for exporters

• Better loans for clean tech

• More trust from buyers

• Lower long-term costs

• Strong brand value in new markets

This support helps small firms and large firms grow at the same time.

How Banks Support Clean Exports

Banks see a clear rise in demand for green loans. They now create simple tools for clean trade. These tools help exporters shift to safe raw goods, better machines, and clean power.

Main ways banks help

• Loans for solar power use

• Credit for low-waste units

• Support for clean supply chain

• Short-term funds for export needs

This mix helps firms change old ways with ease and keep exports steady.

Green Finance in Global Trade in Action

Many Indian exporters now use green funds. They use it to move from old fuel to simple clean power. They use it to cut smoke and waste. They also use it to make safe goods. This makes the export line stronger and more fair.

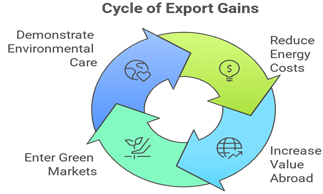

What exporters gain

• Lower energy bills

• More value for goods abroad

• Quick entry into new green markets

• Proof of care for nature

This helps buyers trust Indian goods and pay fair rates. It also helps India hold a stable place in global trade as clean rules grow.

In the middle of this shift, firms see how Green Finance in Global Trade gives them a clear path. It is simple. Clean plans bring better funds. Better funds bring safe growth.

A Clean Path for India’s Export Future

India’s export story is moving to a new phase. Clean plans now guide many steps. Firms that use green funds grow faster. They also keep strong ties with global buyers who want safe goods.

Actions exporters can take

• Check top clean tech options

• Seek simple green loans

• Share clean steps with buyers

• Build long-term clean plans

These steps help exporters stay ready for new rules. They also help India shine as a clean trade leader.

In the end, India needs strong action and clear plans. Clean exports must rise. Green funds must grow. And each step must stay fair. When exporters use Green Finance in Global Trade, they build a safe and steady future for India’s role in global trade.

Ready to scale your green exports? Explore smarter financing now @ http://growmaxfintech.com/