Indian exporters face many challenges, but currency changes create the most stress. A small shift in exchange rates can reduce profit without warning. Managing Currency Risk in Export Finance helps Indian SMEs protect earnings and plan with more confidence. Since export payments often arrive weeks or months later, rate movement becomes unavoidable. When this risk is understood early, businesses can avoid sudden losses and keep cash flow steady.

How currency movement impacts Indian exporters

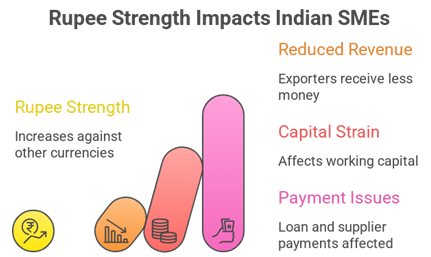

Currency rates change every day due to global trade, interest rates, and economic news. Indian SMEs often agree on prices long before receiving payment. If the rupee strengthens during this gap, exporters receive less money than expected. This can affect working capital, loan repayments, and supplier payments. Many small exporters feel this impact only after money reaches the bank. Awareness of this link helps owners make better decisions before finalising export deals.

Managing Currency Risk in Export Finance through pricing discipline

Export pricing should never depend on hope alone. Indian SMEs must add a small safety margin while fixing prices. This margin helps absorb minor rate changes without hurting profits. Keeping price validity short also limits exposure. Asking for partial advance payments reduces risk further. Clear payment terms improve trust and protect both exporter and buyer. Simple pricing discipline plays a major role in reducing currency pressure.

Banking support that simplifies risk control

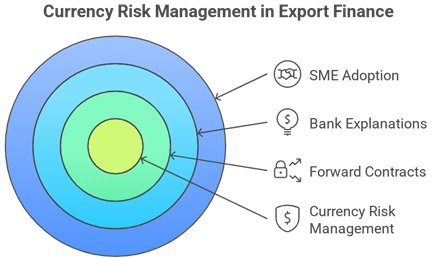

Banks provide tools that help exporters control exchange rate impact. Forward contracts allow exporters to lock rates for future payments. This removes uncertainty and protects expected income. Many SMEs avoid these tools because they sound complex. In reality, banks explain them in simple terms when approached.

Using such tools is a practical way of Managing Currency Risk in Export Finance without changing daily operations.

Strong cash planning for safer export growth

Delayed payments increase currency exposure. Indian SMEs should track export invoices closely and follow up on time. Splitting large orders into stage-wise payments helps limit risk. Keeping export income separate from local business funds improves clarity. This approach makes profit tracking easier and reduces confusion during audits. When cash planning improves, sudden rate shifts cause less damage.

Learning from experience to stay prepared

Every export deal teaches a lesson. Reviewing past orders helps identify where currency movement reduced profit. These insights help improve future pricing and payment terms. Export desks at banks and trade advisors offer helpful guidance. Even small adjustments can make a big difference over time. Businesses that focus on Managing Currency Risk in Export Finance operate with better control and fewer surprises.

Take control of your export earnings with smarter finance support.

Visit http://growmaxfintech.com/ to explore practical export funding and risk support for Indian SMEs