Cash flow gaps are common in export trade. Payments often arrive late. Orders cannot wait. Invoice Discounting for Export Businesses helps exporters stay steady without slowing growth.

Exporters ship goods today but get paid weeks later. This delay can block daily needs. Staff pay, raw material purchase, and freight costs still demand money. This is where invoice discounting brings relief.

Understanding Cash Flow Pressure in Export Trade

Export payments usually follow long credit terms. Buyers take thirty, sixty, or ninety days to pay. During this time, exporters must keep operations moving.

Banks may ask for heavy paperwork or long approval times. Many exporters cannot wait. Invoice discounting offers access to funds using unpaid invoices.

The exporter keeps control of customer relations. The buyer pays as usual. The exporter receives early cash support without new debt stress.

How Invoice Discounting for Export Businesses Works

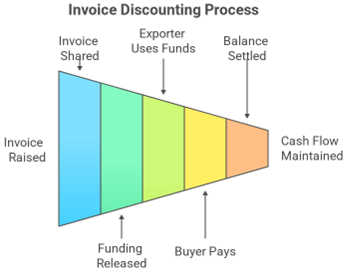

- Invoice discounting allows exporters to receive most invoice value early. The invoice acts as the base for funding. Once raised, it is shared with the finance partner.

- The finance partner releases a major part of the invoice value. The exporter uses this money for daily needs. When the buyer pays, the balance is settled.

- This method supports regular cash flow. It avoids loan pressure. It works best for exporters with steady overseas buyers.

Why Exporters Choose Invoice Discounting

Exporters prefer solutions that fit their trade cycle. Invoice discounting aligns with real business timing. It does not interrupt shipping or sales plans.

Using Invoice Discounting for Export Businesses, exporters can accept larger orders. They can negotiate better supplier rates. They can avoid missing shipment deadlines.

It also reduces reliance on personal savings. It limits stress caused by delayed payments. The exporter focuses on growth, not cash gaps.

Key Benefits for Growing Export Businesses

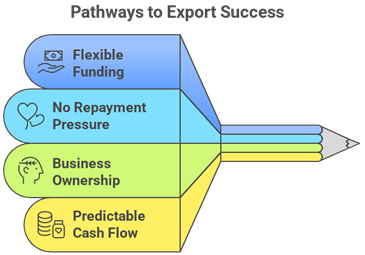

Invoice discounting offers flexible access to funds.

- It grows with sales volume. As invoices increase, funding also increases.

- It avoids long-term repayment pressure. There is no fixed monthly loan burden. Payment depends only on buyer settlement.

- Exporters keep ownership of their business. There is no equity sharing. Cash flow becomes predictable and smooth.

- This makes Invoice Discounting for Export Businesses suitable for small and mid-size exporters. It supports growth without heavy risk.

Is Invoice Discounting the Right Choice

Invoice discounting suits exporters with regular buyers. It works well for businesses with clear invoices and payment records.

Before choosing, exporters should review costs. They should understand payment timelines. They should select trusted finance partners.

When used well, Invoice Discounting for Export Businesses becomes a steady support system. It turns waiting time into working capital

“Keep your export work moving with quick cash. Contact us @http://growmaxfintech.com/”