Small businesses face many hurdles when they try to get loans. Long checks, slow reports, and unclear risk scores delay their growth. This is where AI-Driven Credit Analytics steps in. It gives lenders clear data and fast reports. It also helps honest small firms get funds with less stress and less waiting.

Why SMEs Need Better Credit Checks With AI-Driven Credit Analytics

Most small firms do not have strong papers or long credit history. Many depend on early payments and short cycles to run their work. Banks often find it hard to judge their risk. A simple score does not tell the full story.

This is where AI-Driven Credit Analytics offers a clear edge. It reads many data points and gives lenders better insight.

How Fintech Uses AI for Strong and Clear Lending

Fintech firms now use AI tools to check cash flow, past bills, vendor history, and tax data. These simple steps help them understand real business health.

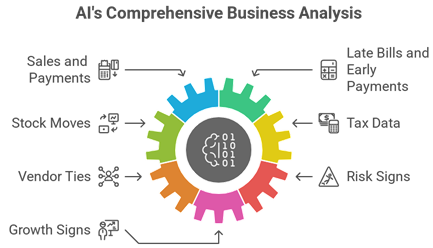

Here is how the process works:

- AI scans daily sales and payments.

- It studies late bills, early payments, and stock moves.

- It checks tax data and vendor ties.

- It spots risk signs and growth signs in minutes.

These steps give lenders a clear view of each firm. They also help honest firms get funds with less delay.

In the middle of this process, AI-Driven Credit Analytics plays the most important role. It turns raw data into simple reports that even small teams can read with ease.

How This Change Helps Small Firms Grow

Fintech firms cut wait times. Loans that once took weeks now take days. Some even take hours. This helps small firms buy supplies on time, handle orders, and manage sudden needs.

Key gains for small firms:

- Faster loan checks

- Fair risk scores

- Better loan plans

- Quick access to funds

- Clear reports they can understand

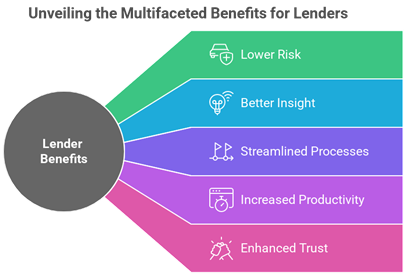

Key gains for lenders:

- Lower risk

- Better insight

- Simple reports

- Less manual work

- Higher trust from firms

This shift helps both sides. Firms grow, and lenders stay safe.

The Future of SME Lending With AI

AI will continue to guide loan checks. It will read more data types and find deeper patterns. It may even suggest the best loan plan for each firm. This will make the lending space more open and fair.

For now, the heart of this change remains clear. Strong tools, clean data, and simple reports help lenders make good choices and help small firms grow with steady support.

And all of this progress is shaped by AI-Driven Credit Analytic.

Join with us @ https://growmaxfintech.com/ and Start using clear credit data to make better lending decisions.