In today’s business world, strong cash flow and vendor trust go hand in hand. Many companies struggle to balance payments, manage inventory, and keep suppliers happy. This is where Supply Chain Finance Strategies for Indian SMEs can make a difference. When planned well, they help businesses stay liquid while keeping every link in the chain steady.

Understanding the Role of Supply-Chain Finance

Supply-chain finance is not just about early payments. It’s a system that connects buyers, suppliers, and financial institutions. The goal is simple improve working capital and keep trade moving. Buyers get extended payment terms. Suppliers receive faster payments. Both gain better control over cash flow.

Companies use these methods to remove stress from vendor relations. Instead of waiting for 60 or 90 days, suppliers can get their money sooner. This builds trust and keeps supply lines strong even during market changes.

Smart Supply Chain Finance Strategies for Indian SMEs for Better Results

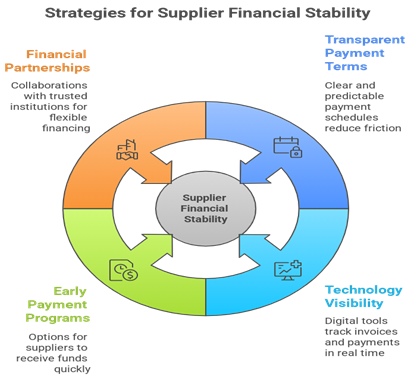

- Adopt transparent payment terms

Clear and predictable timelines reduce friction. Vendors plan their operations better when payments are consistent. - Use technology for visibility

Digital tools track invoices and payments in real time. This transparency lowers disputes and improves coordination. - Offer early payment programs

Early settlement options give suppliers instant access to funds. Buyers may even earn discounts for quick payments. - Partner with reliable financial institutions

Trusted lenders or fintech platforms can provide flexible financing models. This helps both large and small suppliers stay stable.

How These Strategies Improve Relationships

Suppliers are the backbone of any business. When they feel valued and secure, they respond with loyalty and better service. Smooth payment cycles reduce delays and tension. A supplier who doesn’t worry about late payments focuses more on quality and timely delivery.

For example, when a manufacturing firm adopts modern Supply Chain Finance Strategies for Indian SMEs, it can negotiate fairer prices. Vendors appreciate the assurance of prompt cash flow. This creates a healthy ecosystem where both sides grow together.

Building Strong Cash Flow

Cash flow problems often start with payment gaps. Companies that rely on manual approvals or complex credit policies face delays. With the right systems, payments can move faster, and capital stays in rotation.

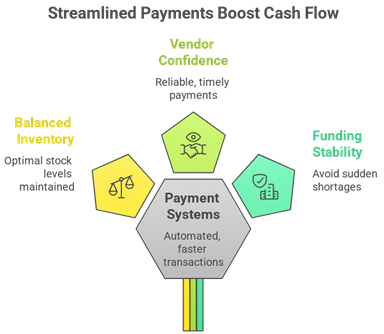

When supply-chain finance aligns with operations, the impact is direct:

- Inventory stays balanced.

- Vendors remain confident.

- Businesses avoid sudden funding shortages.

Every rupee moves with purpose from purchase to sale, then back into growth.

A Continuous Cycle of Trust and Growth

The strength of a business lies in its relationships. Consistent cash flow is the bridge between promise and delivery. Companies that invest in clear, fair, and flexible systems build long-term credibility. Vendors who get paid on time stay loyal. That loyalty reduces risks and supports expansion.

In the end, Supply Chain Finance Strategies for Indian SMEs are more than financial tools. They are a way to connect trust with performance. By keeping payments smooth and partnerships steady, every business can turn finance into a source of strength not stress.

Ready to strengthen your cash flow? Start implementing effective Supply Chain Finance Strategies for Indian SMEs now with us.