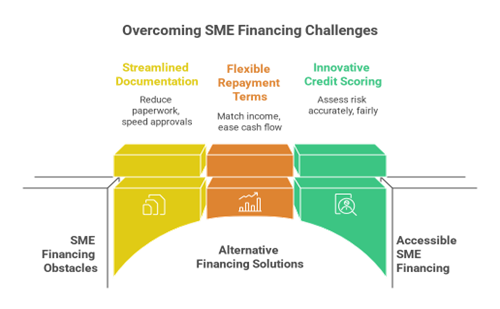

In today’s rapidly evolving business environment, access to effective and reliable financing is crucial for small and medium-sized enterprises (SMEs). However, many still struggle to secure timely funding due to complex procedures and traditional lending barriers. Business Financing for SME are now essential to help companies overcome these financial challenges and achieve long-term sustainability.

Understanding the challenges faced by SMEs

SMEs form the foundation of most economies, driving innovation, employment, and regional development.

Yet, they often face hurdles such as:

- Limited access to credit: Traditional financial institutions often categorize SMEs as high-risk, resulting in rejected loan applications.

- Extensive documentation: The lengthy paperwork and approval times slow down business momentum.

- Cash flow issues: Irregular income cycles make it difficult to maintain working capital and support daily operations

These obstacles highlight the growing need for Business Financing for SME that simplify access to funds while fostering innovation and scalability.

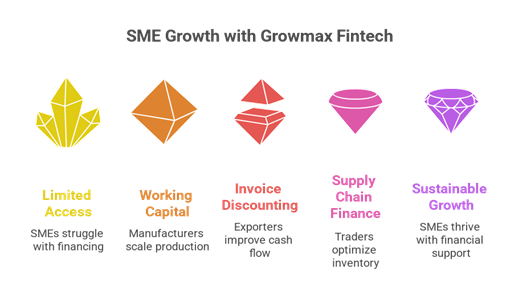

Growmax fintech: Redefining SME financing

Growmax fintech is revolutionizing the way SMEs access and manage funds. By integrating advanced digital tools and financial intelligence, Growmax provides seamless and efficient financing experiences through:

- Invoice discounting: Unlock immediate cash flow by leveraging outstanding invoices, both LC and non-LC.

- Supply chain finance: Improve vendor and distributor partnerships through smart financing that enhances operational efficiency.

- Business loans: Obtain flexible, fast, and tailored credit lines to expand business operations.

- Working capital solutions: Address liquidity needs with customized funding options that promote smooth business continuity.

These innovative products enable SMEs to operate efficiently, ensuring they remain competitive and adaptive in the digital economy.

Success stories: SMEs Thriving with growmax fintech

Many businesses have experienced measurable growth through growmax’s financing models:

- Manufacturers: Enhanced production capacity through improved working capital access.

- Exporters: Accelerated payments via invoice discounting, improving international competitiveness.

- Distributors: Strengthened supply chain operations with tailored financial support.

These success stories demonstrate how digital lending can drive real-world business growth.

Driving Success with Business Financing for SME

Growmax fintech empowers SMEs by combining technology with accessibility. The platform delivers key benefits such as:

- Quick loan approvals: AI-powered assessment tools minimize delays and simplify lending.

- Real-time tracking: Businesses can monitor loan performance through interactive dashboards.

- Seamless integration: Compatible with accounting and ERP systems for smooth financial management.

- Multi-channel access: Available via web, mobile, and chat for on-the-go convenience.

Through these digital tools, Growmax Fintech ensures that Business Financing for SME remain fast, transparent, and reliable.

Fueling the next phase of SME Success

As the digital economy expands, SMEs must adopt innovative financial tools to remain agile and competitive. Growmax fintech’s Business Financing for SME empower enterprises to overcome financial limitations, embrace technology, and scale efficiently.

Ready to transform your business? Partner with Growmax Fintech and experience financial solutions designed to accelerate your growth journey.