In today’s fast-moving world, managing finances can be challenging. Many people struggle to track spending, plan investments, and save effectively. The Future of Smart Secure and Simple Financial Management with Growmax Fintech offers a solution by combining simplicity, security, and smart technology. With this platform, users can organize their money, make informed decisions, and grow their wealth confidently without feeling overwhelmed.

Simplicity Makes Financial Management Easier

One of the main reasons people avoid using financial tools is complexity. Complicated apps, confusing reports, and unclear instructions make managing money stressful. Growmax Fintech addresses this problem with a simple and intuitive interface. Users can view their accounts, track expenses, and set budgets with just a few clicks. Simplicity helps users stay consistent in managing their finances, making it easier to achieve long-term goals.

Prioritizing Security for Peace of Mind

Security is a top priority when it comes to handling money online. Growmax Fintech ensures that all personal and financial data is protected using advanced encryption methods. Multi-factor authentication and secure servers guarantee that sensitive information remains safe. Users can confidently perform transactions and monitor investments without worrying about data breaches or unauthorized access. Security allows users to focus on financial growth rather than potential risks.

Smart Features to Guide Financial Decisions

Technology can make financial management smarter and more effective. Growmax Fintech offers intelligent tools that analyze spending habits, track investment performance, and provide tailored recommendations. These insights help users make informed decisions and avoid costly mistakes. The Future of Smart Secure and Simple Financial Management depends on integrating smart technology with easy-to-use platforms. Growmax Fintech achieves this by providing data-driven guidance in a format that everyone can understand.

Real-Time Tracking and Personalized Planning

Monitoring finances in real-time can significantly improve decision-making. Growmax Fintech allows users to track income, expenses, and investments instantly. The platform also offers personalized planning options, such as setting financial goals, budgeting for upcoming expenses, and creating saving plans.

- Clear View of Financial Health: Users can act proactively instead of reacting to problems later.

- Simplified Everyday Management: Tracking and planning tools make daily finance tasks efficient and easy.

This combination of monitoring and planning ensures that managing money is both simple and effective.

Benefits for Daily Financial Management

Using Growmax Fintech brings practical advantages to individuals and businesses alike:

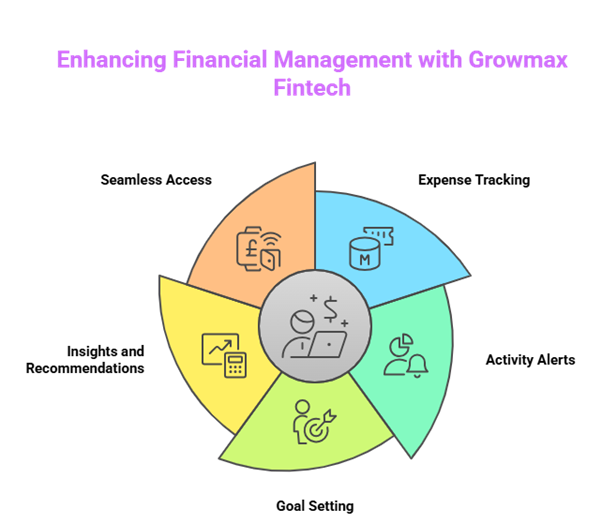

- Keep track of spending and categorize expenses automatically

- Receive alerts for unusual activity or bill reminders

- Set and monitor financial goals for savings or investments

- Access insights and recommendations for smarter decision-making

- Use the platform seamlessly on mobile and desktop devices

These features make managing money less stressful and more productive. Users can focus on growth, planning, and achieving long-term goals rather than worrying about mistakes or overlooked details.

Preparing for a Confident Financial Future

The world of finance is evolving, and having a platform that is simple, secure, and smart is essential. Growmax Fintech empowers users to take control of their financial future. By combining safety, ease-of-use, and intelligent guidance, the platform ensures that financial management is not only possible but also enjoyable. Individuals can feel confident making investments, tracking expenses, and planning for life’s milestones.

Ultimately, The Future of Smart Secure and Simple Financial Management with Growmax Fintech is here to transform the way people handle money. With Growmax Fintech, users no longer need to compromise between security, simplicity, and smart tools. The platform offers all three, making it the perfect solution for modern financial needs