For small and medium businesses, an IPO represents a key step forward. It helps businesses raise capital, enhance brand visibility, and provide liquidity for investors. Still, a lot of entrepreneurs view the process as challenging. This guide by Growmax Fintech breaks it down clearly and shows how SME IPOs on NSE Emerge can help companies grow with confidence.

What Are SME IPOs on NSE Emerge?

The National Stock Exchange offers NSE Emerge, a platform aimed at supporting small and medium enterprises. It allows growing businesses to raise funds and gain visibility without the strict requirements of the main board.

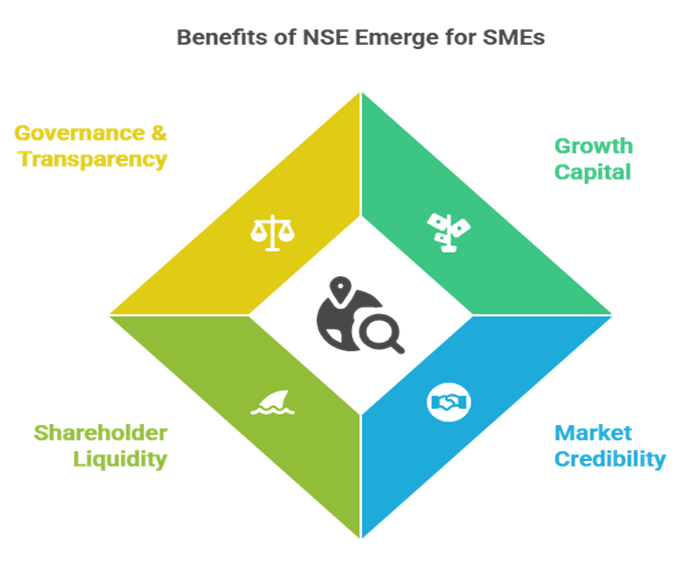

The platform gives SMEs a chance to:

- Raise growth capital

- Gain credibility in the market

- Create liquidity for existing shareholders

- Strengthen governance and transparency

By choosing this route, SMEs make themselves more attractive to investors while keeping compliance manageable.

Eligibility and strategy

Before beginning the journey, every company must check eligibility. NSE requires a minimum track record, specific capital levels, and a structured business model. These checks ensure that only serious, growth-ready businesses apply.

A well-planned strategy is essential when preparing for SME IPOs on NSE Emerge. Companies should define why they want to list, whether to expand operations, invest in technology, or provide an exit to early investors. A clear plan makes the IPO more purposeful and convincing for stakeholders.

Build your IPO team

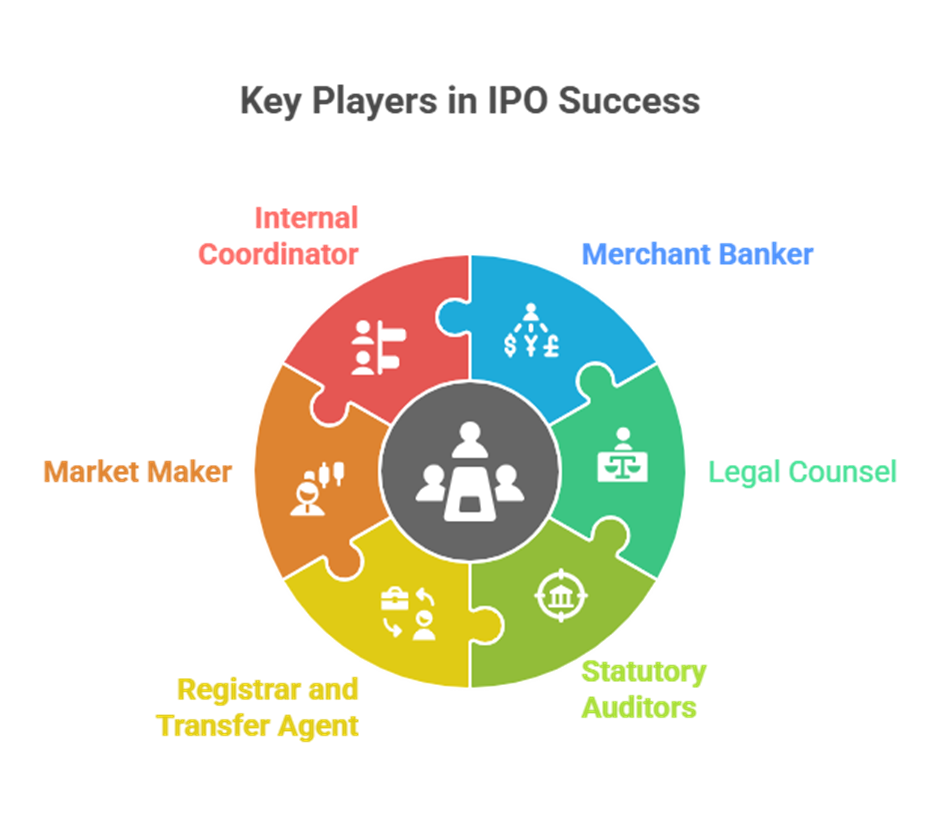

No SME can handle the process alone. A strong advisory team ensures compliance and smooth execution.

The key members of the IPO team include:

- Merchant banker (lead manager)

- Legal counsel

- Statutory auditors

- Registrar and transfer agent

- Market maker (specific for SME IPOs)

Internally, companies should appoint a coordinator to keep communication flowing between external advisors and management. This balance keeps the process on track.

Due diligence and documentation

This stage is paperwork-heavy but absolutely essential. The Draft Red Herring Prospectus (DRHP) is created to detail the company’s business model, potential risks, and growth plans. Corporate records, licenses, and financial statements are thoroughly reviewed by advisors and regulators.

A few best practices here are:

- Maintain accuracy across all documents

- Be transparent about risks and challenges

- Use simple, investor-friendly language

Clear disclosures build trust, while incomplete or exaggerated claims can slow down approvals and harm credibility.

Valuation, pricing, and marketing

Valuation is one of the most critical steps. It should reflect both the company’s fundamentals and its growth potential, rather than inflated numbers. Overpricing may harm long-term investor confidence.

Marketing the IPO is equally important. Companies usually conduct roadshows, investor presentations, and targeted outreach.

Mistakes SMEs should watch out for

Several SMEs commit mistakes that could be easily avoided during the IPO process. The most common include:

- Rushing documentation at the last moment

- Overstating future projections

- Weak internal governance practices

- Poor post-listing financial planning

Avoiding these mistakes ensures the IPO journey is smoother and builds lasting investor confidence.

The road ahead for SMEs

Listing on NSE Emerge is more than just a fundraising exercise, it’s the start of a new chapter. With careful preparation, the right advisors, and a commitment to transparency, SMEs can turn the IPO journey into a growth accelerator. Success doesn’t stop at ringing the bell; it comes from building trust, delivering consistent results, and showing investors that your business is ready for the long run. For ambitious SMEs, the road ahead is full of opportunities waiting to be unlocked.