In today’s dynamic financial landscape, SME invoice financing risk compliance has become a critical concern for both lenders and small to mid-sized enterprises. As invoice financing continues to gain traction as a viable funding alternative, ensuring compliance while managing risk has never been more vital. Trust plays a central role in this process—acting as the glue that holds partnerships together and enables smooth transactions at Growmax fintech.

Understanding SME invoice financing risk compliance

SME invoice financing risk compliance refers to the measures and regulations that ensure both lenders and SMEs follow established standards while engaging in invoice-based funding.These standards not only protect financial institutions from fraud but also ensure timely repayment and, moreover, maintain transparency in funding operations.

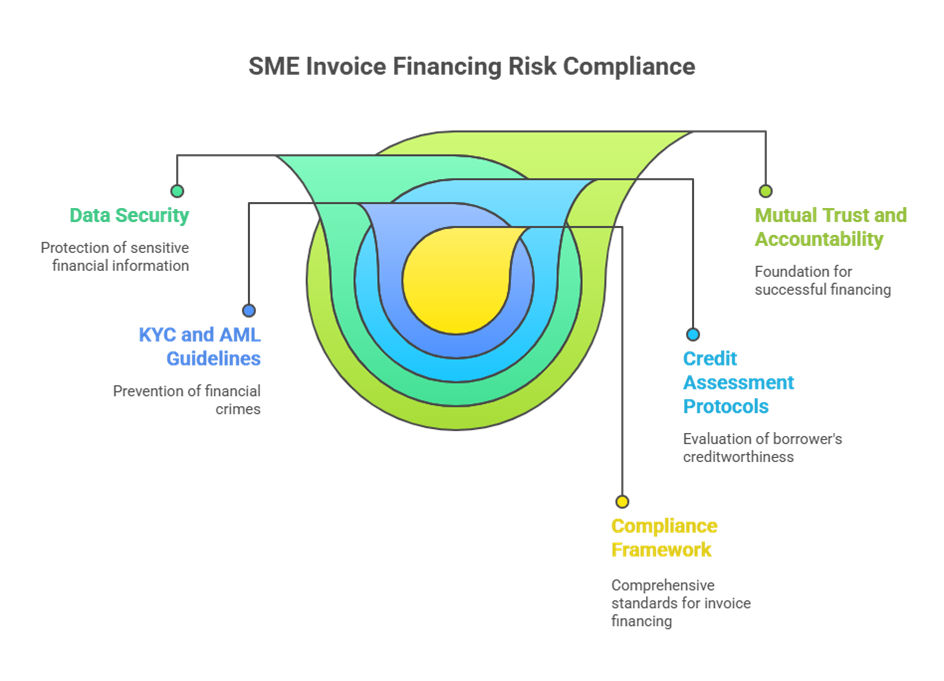

From KYC norms and anti-money laundering (AML) guidelines to credit assessment protocols and data security, compliance frameworks are extensive. Any gaps in this system can expose businesses to operational and reputational risk. That’s why financial institutions, fintech firms, and borrowers must work together within a framework of mutual trust and accountability.

Why trust is the foundation of compliance

Compliance frameworks are only as effective as the people enforcing them. Trust enhances the willingness of all parties to meet regulatory standards. When SMEs trust their financiers, they’re more likely to share accurate documentation, disclose financial history, and maintain clear communication. Similarly, when lenders trust the businesses they fund, they offer better rates and more flexible financing solutions.

Parties build trust through reliability, openness, and respect—not overnight. In invoice financing, where transactions often involve high-value invoices and short turnaround times, trust reduces friction and accelerates decision-making.

Risk areas that demand attention

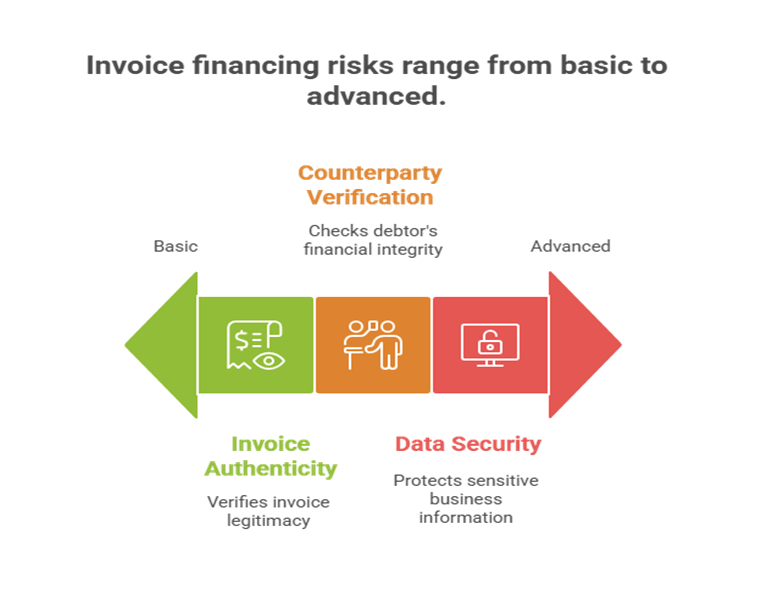

While invoice financing offers quick liquidity, it also comes with inherent risks. Here are key areas where trust and compliance intersect:

1. Invoice authenticity

Fake or duplicated invoices are one of the biggest threats in invoice financing. A compliant SME will have strong internal checks, while a trustworthy financier will conduct due diligence before releasing funds.

2. Counterparty verification

Performing KYC and confirming the financial integrity of the end debtor is critically important. Lenders must trust that the SME has invoiced a legitimate and solvent client. Failure in this area can lead to unrecoverable losses.

3. Data security and privacy

With growing digital adoption, invoice financing platforms collect sensitive business data. Ensuring cybersecurity compliance and maintaining data integrity are non-negotiable elements in modern risk compliance

How Fintech is enabling trust and compliance

Modern fintech platforms are transforming how businesses approach SME invoice financing risk compliance. They leverage automation, AI-driven credit assessment, and blockchain for secure record-keeping. These tools make compliance processes more efficient and less error-prone.

Additionally, digital platforms enable real-time tracking, instant verification, and improved communication between SMEs and lenders. This not only reduces risk but also fosters a transparent environment where trust can thrive.

Role of smart contracts

Smart contracts ensure that invoice terms are executed exactly as agreed, eliminating the need for manual intervention. Automatic payment is initiated once the predefined criteria are completed. This minimizes disputes and boosts confidence among stakeholders.

Building a culture of compliance

Treating compliance as a strategic advantage instead of just a legal obligation can transform how SMEs operate. Embedding compliance into daily operations and training staff on risk protocols promotes a culture of responsibility.

Clear onboarding, regular audits, and educational resources from financiers build trust with SMEs. These efforts make SMEs feel supported rather than scrutinized.