In the fast-evolving world of global commerce, exporters face a complex mix of challenges—from securing capital to managing cash flow gaps. Among the most powerful tools enabling them to succeed today are flexible trade credit solutions. At the forefront of this transformation is Growmax Fintech, a forward-thinking company helping exporters streamline their financial strategies through innovative, tech-powered lending systems.

The growing need for tech in export financing

Exporters, especially small and medium-sized enterprises (SMEs), often encounter delayed payments, high credit risks, and limited financing options. Traditional banking methods are often too slow and rigid to support the dynamic nature of international trade.

This is where Growmax Fintech steps in. By combining financial technology with deep industry expertise, the company offers exporters faster, more flexible credit tools that match the pace of global trade. These trade credit solutions are designed to improve liquidity, minimize risk, and support uninterrupted business operations..

How flexible trade credit solutions benefit exporters

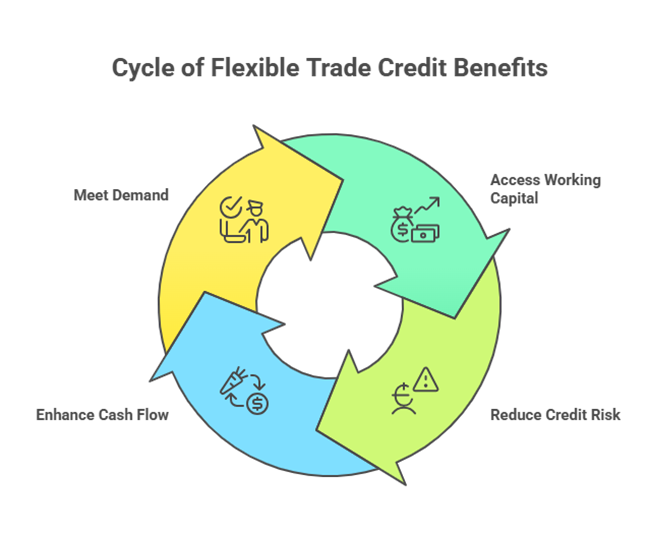

Flexible trade credit isn’t just about getting paid later—it’s a strategic enabler of growth. Let’s explore how Growmax Fintech is reshaping the landscape for exporters through smart credit tools.

Faster access to working capital

Waiting for international clients to settle invoices can take weeks—or even months. With Growmax’s digital financing solutions, exporters can access funds almost immediately after dispatching goods. This speeds up cash flow, allowing them to reinvest in operations and meet demand without disruption.

Reduced credit risk

Through real-time analytics and credit scoring algorithms, Growmax evaluates the financial reliability of buyers before extending credit. This minimizes the risk of defaults and protects exporters from financial shocks.

Moreover, automated reminders and structured repayment plans add a layer of security, keeping transactions transparent and timely.

Smart flexible trade credit solutions built for the modern exporter

Technology has changed the way businesses function, and financial services are no exception. Growmax Fintech’s flexible trade credit solutions leverage automation, artificial intelligence, and cloud-based platforms to simplify and accelerate the entire credit process.

From credit assessment to disbursement and collections, everything is handled through a unified digital interface. Exporters can monitor transactions, manage risks, and plan financing—all from a single dashboard.

One of the key benefits here is scalability. As businesses grow, their credit needs evolve. Growmax adapts in real time, offering customized credit limits and repayment structures that suit the exporter’s growth trajectory.

Real-world impact: a competitive advantage

Many exporters using Growmax Fintech’s platform report significant improvements in operational efficiency. With predictable cash flows and lower dependency on high-interest loans, they gain a competitive edge in the market.

Unlike traditional financing, these tools are built to move with the business—not slow it down. Exporters can now negotiate better terms with buyers, expand into new markets, and handle bulk orders with ease.

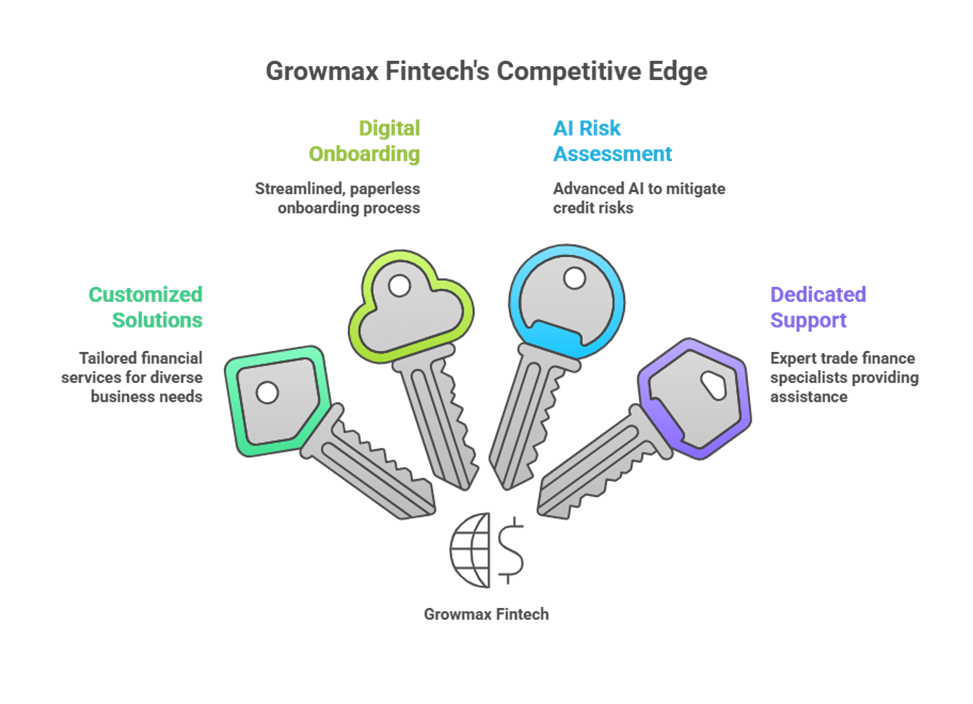

Why choose Growmax Fintech?

There’s no shortage of fintech providers in today’s market. However, what sets Growmax apart is its deep focus on exporter needs, combined with industry-leading technology.

- Customized financial solutions based on business size and sector

- End-to-end digital onboarding with minimal paperwork

- AI-powered risk assessment to prevent credit defaults

- Dedicated support from trade finance specialists

Therefore, these features make Growmax a preferred choice for forward-looking exporters, as they seek more than just funding—they aim for smart growth