Running a small or medium business in India in 2026 is challenging, especially when payments from customers are delayed but expenses never wait. This is where invoice discounting for SMEs to fix cash flow gaps becomes a powerful lifeline for growing companies.

What Is Invoice Discounting for Indian SMEs?

Invoice discounting is a simple working capital solution that allows SMEs to get early payment against their unpaid invoices instead of waiting 30,60,90 or 120 days.

- You raise an invoice to a reliable buyer

- A finance partner advances a percentage of the invoice value

- You receive funds quickly while the buyer pays later as usual

This helps businesses manage salaries, raw materials, and daily expenses without taking long-term loans or giving additional collateral.

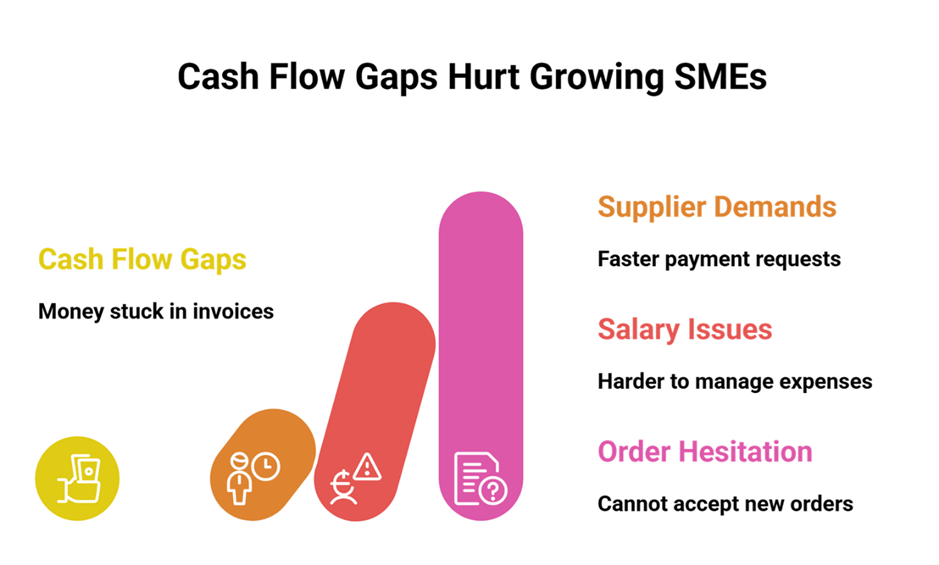

Why Cash Flow Gaps Hurt Growing SMEs

When money is stuck in invoices, even profitable businesses feel the pressure.

- Suppliers start demanding faster payments

- Staff salaries and overheads become harder to manage

- New orders cannot be accepted confidently

In this situation, using invoice discounting for SMEs to fix cash flow gaps is often safer than taking a traditional loan because it is based on confirmed invoices, not just projections.

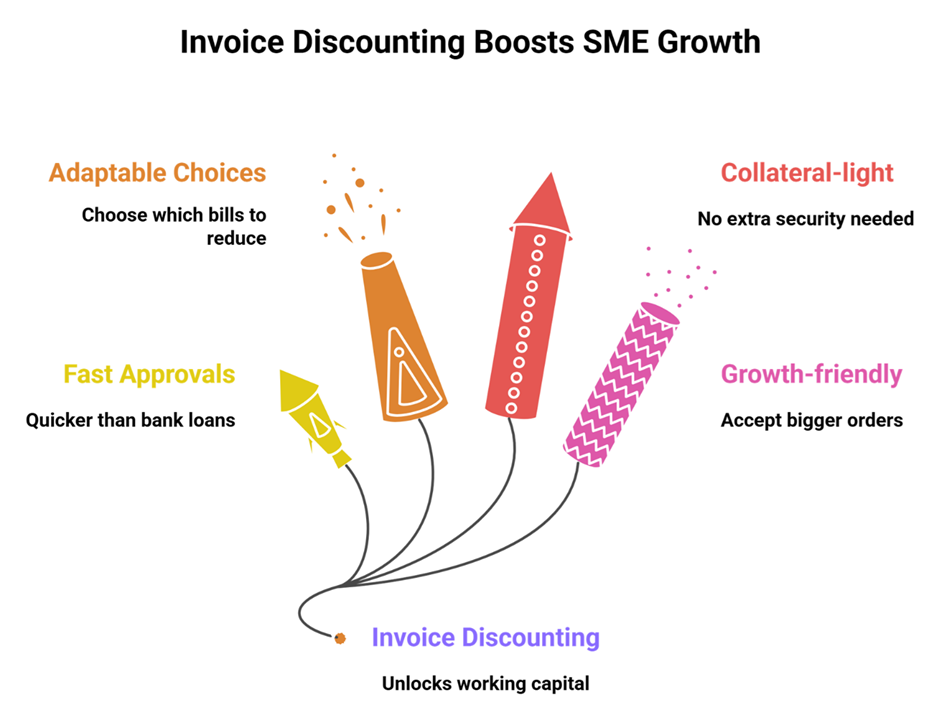

Key Benefits of Invoice Discounting in 2026

Indian SMEs are choosing invoice discounting more than ever in 2026 because it is:

- Fast: Approvals and disbursals are much quicker compared to bank loans

- Adaptable: You choose which bills to reduce and when

- Collateral-light: Often does not require extra security beyond the invoice

- Growth-friendly: Cash is unlocked to accept bigger orders and new clients

Instead of delaying payments or losing supplier trust, SMEs can convert pending invoices into working capital and keep operations smooth.

How Platforms Like Growmax Fintech Add Value

Digital platforms have made invoice discounting for SMEs to fix cash flow gaps easier and more efficient. Growmax Fintech connects SMEs and MSMEs with multiple invoice funding companies through a single platform, helping them:

- Compare funding options and choose better rates

- Access LC and non-LC invoice discounting

- Maintain strong relationships with vendors and buyers through timely payments

With tech-driven processes, decisions are faster, documentation is simpler, and SMEs can focus on running the business instead of chasing funds.

Is Invoice Discounting Right for Your SME?

If your business has:

- Regular sales to reliable buyers

- Invoices with clear payment terms

- Frequent cash flow gaps due to delayed payments

…then invoice discounting for SMEs to fix cash flow gaps can be a smart way to stabilize cash flow without increasing long-term debt.

Ready to turn your pending invoices into growth capital? Visit Growmax Fintech and explore how its invoice discounting and working capital solutions can support your SME’s next stage of expansion