Small suppliers often wait 60–90 days or more to get paid by big buyers, which creates serious cash flow stress and stops them from taking new orders. When used correctly, supply chain finance in India gives these suppliers a simple way to convert their approved invoices into quick cash, without chasing payments or taking heavy loans. From paperwork to payout, platforms like Growmax make invoice financing faster and smoother, helping businesses unlock funds with minimal delay.

What is Supply Chain Finance for Small Suppliers?

Supply chain finance is a funding solution where a finance partner pays the supplier early based on the strength of the large corporate buyer. Instead of waiting for the buyers full credit period, the supplier receives most of the invoice value upfront, and the buyer pays the financer later.

- No need for heavy collateral

- Lower cost than many traditional loans

- Simple process once the buyer is onboarded

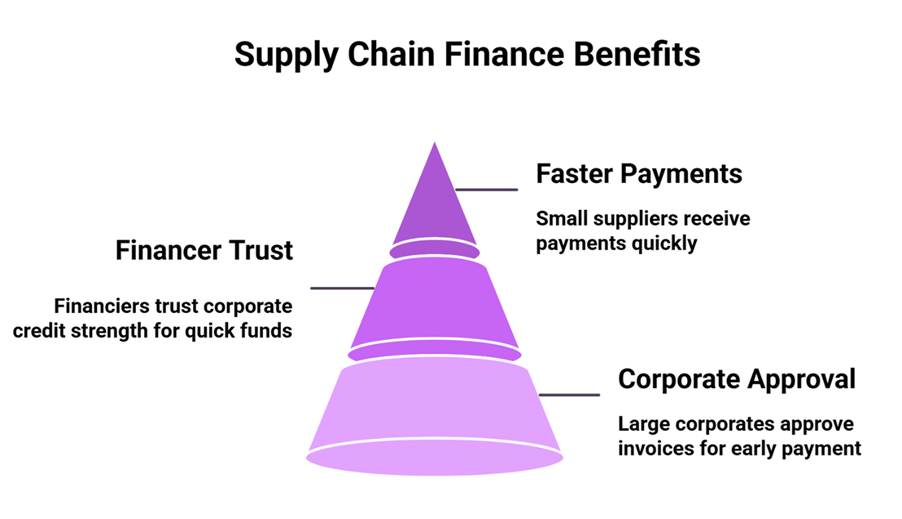

How Large Corporates Support Faster Payments

When large corporates join a supply chain finance in India program, they allow their approved invoices to be used for early payment.

Because the financer trusts the corporate’s credit strength, they are comfortable releasing funds to the small supplier quickly.

This directly leads to faster payments for small suppliers, even when the buyer’s agreed payment terms are long.

Key Benefits for Small Suppliers

- Steady cash flow to manage raw materials, salaries, and daily expenses

- Ability to accept more and bigger orders from large corporates

- Less stress about delayed payments and follow-ups

- Knowing the difference between receivables financing and bank loans helps small businesses pick the better option for smooth cash flow

With early payouts, suppliers can focus on production quality and on-time delivery instead of worrying about overdue invoices.

How It Works in Simple Steps

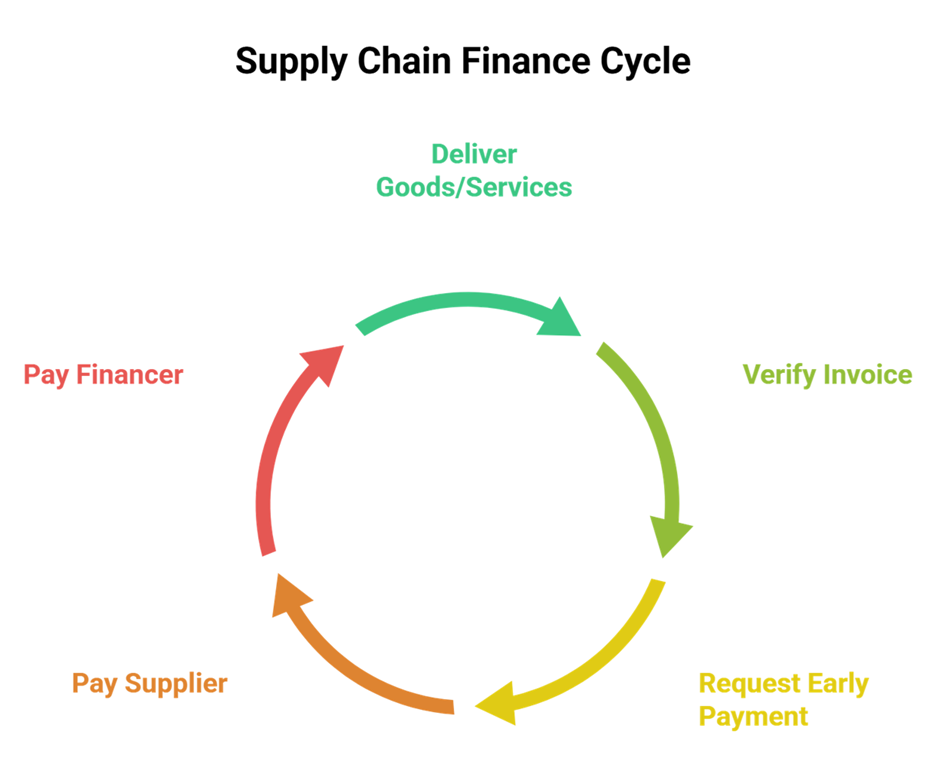

- Supplier delivers goods or services to the large corporate.

- Corporate verifies and approves the invoice.

- Supplier requests early payment through the finance platform.

- Financer pays a major portion of the invoice quickly.

- Corporate pays the financer on the due date.

This cycle keeps repeating, giving faster payments for small suppliers and stable relationships for buyers.

Why Partner with Growmax Fintech

Growmax Fintech connects small suppliers with strong finance partners through structured supply chain finance in India, so they can unlock funds against invoices raised on large corporates without complex paperwork. By using Growmax’s tech-driven platform, suppliers get quicker access to working capital, while buyers enjoy a stronger, more reliable supply chain. At the same time, supply chain financing is rapidly emerging as a center for innovation and growth, driven by digital solutions that benefit both suppliers and buyers.

If you are a small supplier working with big companies and facing payment delays, partner with Growmax Fintech today to turn your invoices into instant working capital and keep your business growth on track.