For small and medium enterprises (SMEs), growth opportunities often depend on access to capital and increased visibility. Getting listed on NSE Emerge is a powerful way to achieve both. However, the process can be overwhelming without expert guidance. This is where Growmax Fintech steps in to help SMEs Get Listed on NSE Emerge with a clear, step-by-step approach.

How Growmax Fintech Helps SMEs Succeed on NSE Emerge

By working with Growmax Fintech, SMEs can overcome the complexities with expert support. Instead, they benefit from industry knowledge, financial expertise, and end-to-end support.

Here’s how Growmax Fintech stands out:

- Expert Advisory: Guidance on eligibility, documentation, and compliance.

- Financial Preparation: Support with valuation, restructuring, and reporting.

- End-to-End Process Management: From initial assessment to final listing.

- Regulatory Compliance: Assistance with SEBI and NSE norms.

- Post-Listing Support: Investor relations and performance tracking.

The step-by-step journey with Growmax fintech

1. Initial consultation and assessment

The journey begins with understanding the SME’s financial health, growth potential, and suitability for NSE Emerge. Growmax Fintech evaluates readiness and designs a roadmap.

2. Structuring and documentation

Accurate documentation is crucial. Growmax Fintech assists with preparing financial statements, disclosures, and other mandatory paperwork required for the listing process.

3. Compliance and approvals

SMEs must comply with NSE and SEBI requirements. Growmax Fintech ensures all legal, financial, and corporate governance standards are met before submission.

4. Filing and coordination with authorities

From coordinating with merchant bankers to filing with the exchange, Growmax Fintech streamlines communication between all stakeholders, minimizing errors and delays.

5. Roadshows and investor outreach

Attracting investors is essential. Growmax Fintech helps SMEs present their growth story effectively through roadshows and presentations, boosting confidence among potential investors.

6. Successful listing and beyond

Once listed, the work doesn’t end. Growmax Fintech provides post-listing support, including compliance monitoring and investor engagement, ensuring long-term growth.

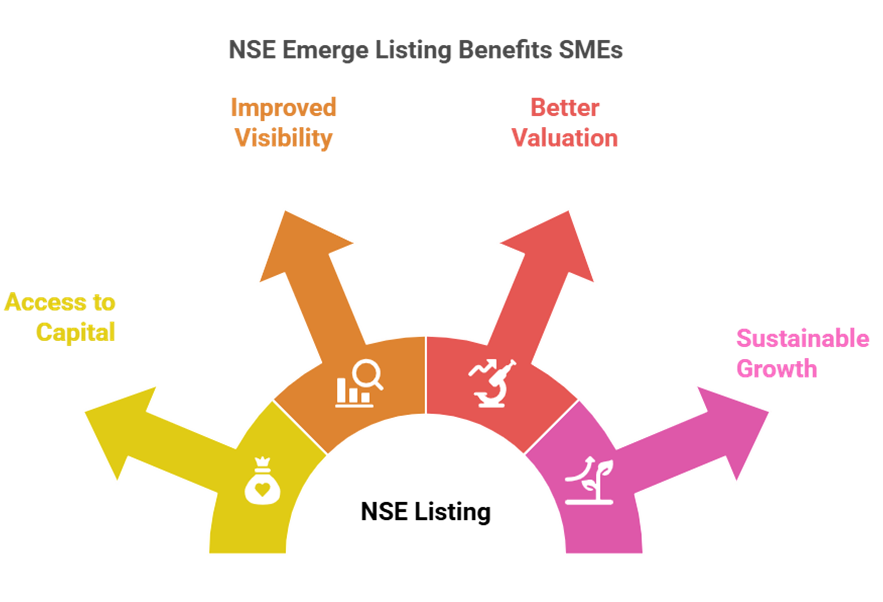

Benefits When SMEs get listed on NSE emerge

When SMEs Get Listed on NSE Emerge, they unlock opportunities that go far beyond funding. By relying on Growmax Fintech, businesses gain access to:

- Improved Visibility: Build stronger credibility with both investors and customers.

- Better Valuation: Strengthen financial standing through transparent practices.

- Sustainable Growth: Long-term strategies for market competitiveness.

- Access to Capital: Raise funds for expansion, innovation, and working capital.

Turning challenges into opportunities with Growmax fintech

For SMEs, listing on NSE Emerge can be a game-changing decision. Yet, without the right expertise, the journey can seem daunting. Growmax Fintech bridges this gap by offering comprehensive, customized solutions. From the first consultation to post-listing support, the company ensures every stage is handled with precision.

With Growmax Fintech, the path becomes clear, structured, and achievable. It’s not just about compliance, it’s about building a strong future where SMEs get listed on NSE emerge and thrive in the competitive market.