In today’s fast-paced business world, small and medium-sized enterprises (SMEs) often struggle to secure credit quickly. The Digital finance revolution is changing this, allowing SMEs to get funds faster and more efficiently. With technology-driven financial tools, businesses can now focus on growth without worrying about cash flow problems.

How the Digital finance revolution is changing SME credit access

The Digital finance revolution has transformed traditional lending. Small businesses no longer have to wait weeks for loan approvals. Fintech platforms provide instant credit solutions, reduce paperwork, and simplify processes. This revolution helps SMEs meet working capital needs, invest in expansion, and stay competitive in the market.

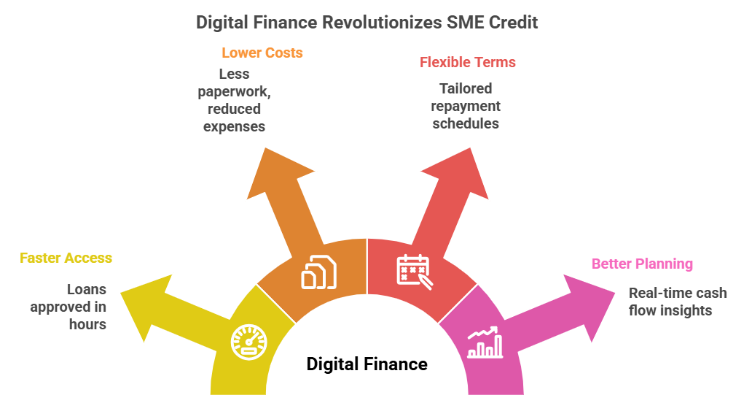

Benefits of instant credit solutions for SMEs

- Faster Access to Funds: Loans can be approved in hours, not weeks.

- Lower Administrative Costs: Less paperwork reduces operational expenses.

- Flexible Terms: Repayment schedules are tailored to fit different business models.

- Better Financial Planning: Real-time insights help manage cash flow efficiently.

These benefits allow SMEs to operate smoothly, even during unexpected financial challenges.

Key features of digital finance platforms

- Automated loan processing: Platforms use AI and smart tools to quickly assess creditworthiness.

- Easy-to-use interfaces: Business owners can apply for credit from computers or smartphones.

- Transparency: Clear terms and instant updates build trust between lenders and borrowers.

- Data Security: Strong encryption keeps business information safe.

These features provide SMEs with a smooth borrowing experience, allowing them to focus on growth instead of paperwork.

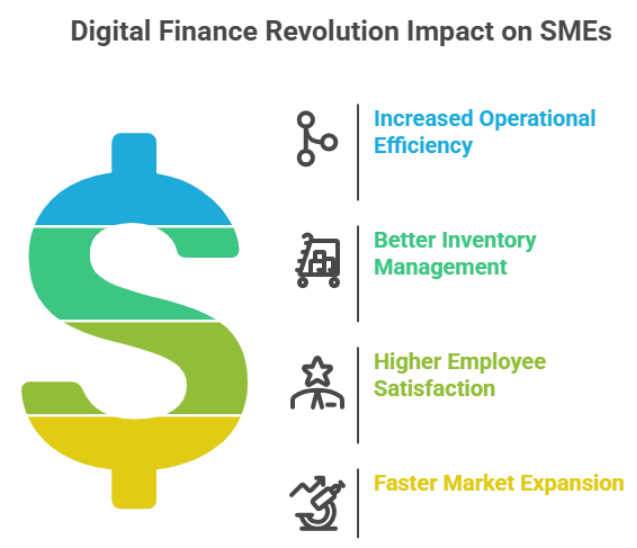

Real-world impact on SMEs

The Digital Finance Revolution is more than a trend it has real results. Businesses using digital credit solutions report:

- Increased operational efficiency

- Better inventory management

- Higher employee satisfaction

- Faster expansion into new markets

By using these tools, SMEs can turn financial challenges into growth opportunities.

Why SMEs should embrace digital finance now

The business world is changing rapidly. SMEs that adopt the Digital Finance Revolution gain faster, smarter, and more reliable access to credit. Waiting for traditional loans can slow growth. Technology-driven financial services give businesses flexibility, stability, and confidence to succeed in today’s economy.

Next steps for your business

The Digital Finance Revolution Empowering SMEs with Instant Credit Solutions is not just a trend, it is a necessity. Instant credit options and easy-to-use digital platforms make financial management simple and efficient for SMEs. Using these tools helps businesses stay competitive, seize opportunities, and grow steadily. Growmax Fintech provides these innovative solutions, helping SMEs access funds quickly and confidently. Embrace digital finance today and watch your SME thrive.