Indian MSMEs are working harder than ever, yet many still struggle to pay salaries, buy raw materials, or take new orders on time. The Hidden Cost of Late Payments is not just about waiting a few extra days for money; it is about lost growth, mounting stress, and a constant cash crunch that quietly weakens even strong businesses. Exploring how GrowmaxFintech helps address SME payment delays can offer practical solutions to ease this financial pressure.

The silent cash flow trap for MSMEs

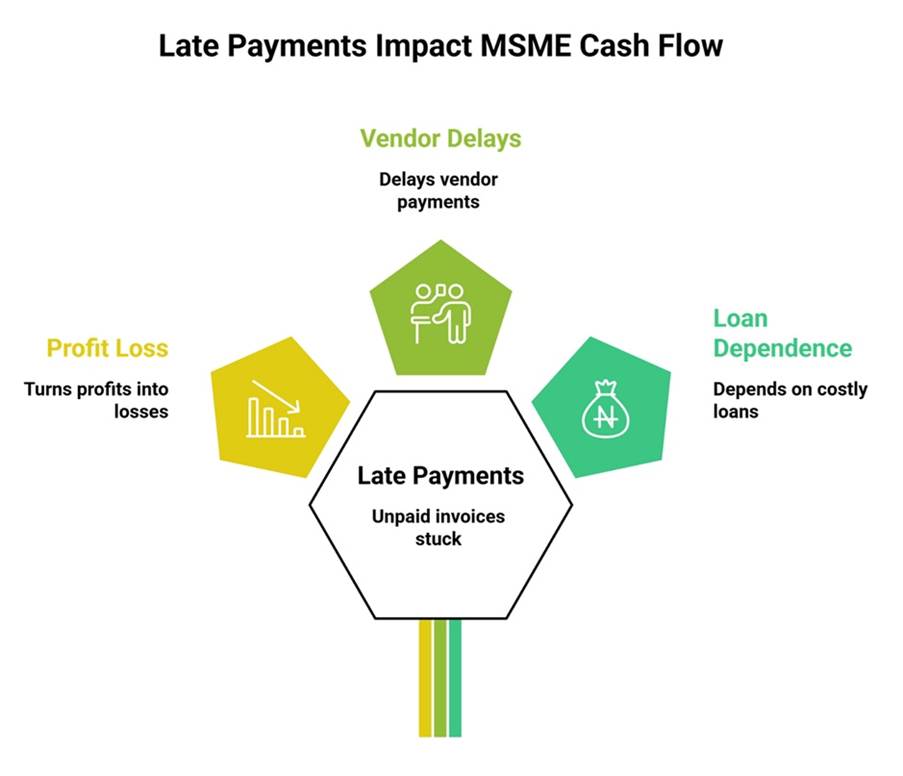

Across India, thousands of MSMEs are stuck with huge unpaid invoices for weeks or even months. This creates a daily battle to keep the business running.

Late payments lead to:

- Delays in paying suppliers

- Limited working capital for daily operations

- Extra borrowing at high interest

- Missed opportunities to take new orders

This is how late payments affect cash flow in a very real way – every delayed rupee blocks the next step in your business cycle. Exploring financial factoring solutions can help accelerate payments and restore healthy cash flow.

Hidden Cost of Late Payments on growth

When money is stuck with customers, MSMEs often:

- Cut down production

- Reduce marketing and expansion plans

- Say no to large or urgent orders

The Hidden Cost of Late Payments also appears in non-financial ways. Owners face constant pressure, teams feel insecure, and long-term planning becomes difficult because cash flow is never predictable.

How late payments affect cash flow in numbers

Unpaid dues running into thousands of crores show clearly how late payments affect cash flow at a national level. For a single MSME, even a few big invoices stuck for 60–90 days can:

- Turn profits into losses

- Force you to delay vendor payments

- Push you to depend on costly short-term loans

Over time, these patterns can damage credit scores and strain relationships with both buyers and suppliers.

Hidden Cost of Late Payments and the role of invoice discounting

The Hidden Cost of Late Payments does not have to remain a permanent problem. With digital invoice discounting, MSMEs can unlock a large part of their invoice value before the due date, instead of waiting endlessly for customer payments. This modern approach also helps businesses avoid long queues and the uncertainty often experienced outside traditional banks.

Through platforms like Growmax Fintech, businesses can:

- Convert approved invoices into quick working capital

- Reduce dependency on unsecured loans

- Maintain steady cash flow for salaries, stock, and new orders

Take control of your cash flow with Growmax

If late payments are slowing down your business, it is time to turn your invoices into strength instead of stress. Growmax Fintech helps MSMEs access fast, flexible invoice discounting so you can keep your cash flow healthy and your growth plans on track.

Talk to Growmax Fintech today to overcome the Hidden Cost of Late Payments and move your business towards stable, predictable cash flow.