Small and medium businesses across India often wait 60–90 days to get paid, which directly affects salaries, inventory, and daily expenses. The Advantages of Invoice Discounting for SMEs become very clear when you see how quickly unpaid invoices can be turned into working capital without taking a heavy long-term loan.

What Is Invoice Discounting for SMEs?

Invoice discounting for SMEs is a simple way to get money early against approved invoices instead of waiting for buyers to pay.

- You raise an invoice to a trusted buyer

- A finance partner funds a major part of that invoice

- You use this cash to run and grow the business

- Technology-Driven Invoice Discounting for Exporters

This way, your business does not stop just because payments are delayed.

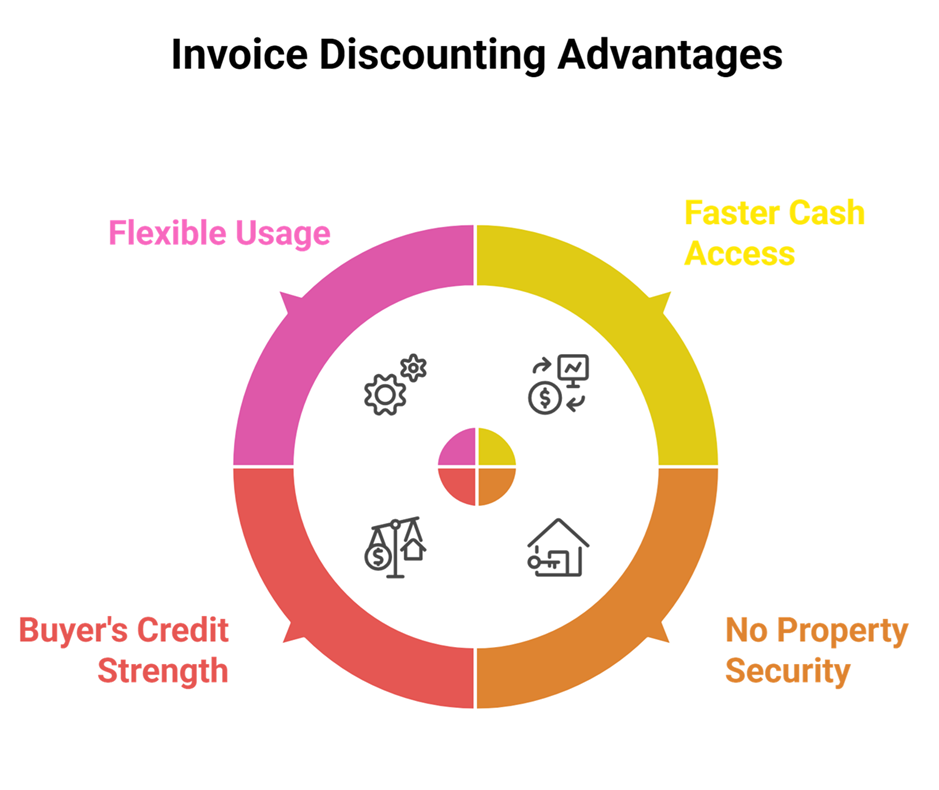

Key Advantages of Invoice Discounting for SMEs

Some of the main Advantages of Invoice Discounting for SMEs in India are:

- Faster access to cash without waiting for buyers

- In most situations, there is no need to provide property as security.

- Credit is based more on your buyer’s strength than only on your balance sheet

- Flexible usage for salaries, raw materials, or new orders

Improve Cash Flow Without Extra Debt

Many business owners worry about taking fresh loans and adding more EMIs every month. With invoice discounting for SMEs, you are mainly using your own confirmed invoices to unlock cash. The Rising Use of Invoice Discounting by Indian SMEs to Fix Cash Flow Gaps in 2026.

- No large term loan burden

- Short-tenure funding linked to invoice due dates

- Better control over inflows and outflows

This helps SMEs accept more orders and never say no to business only because old bills are still unpaid.

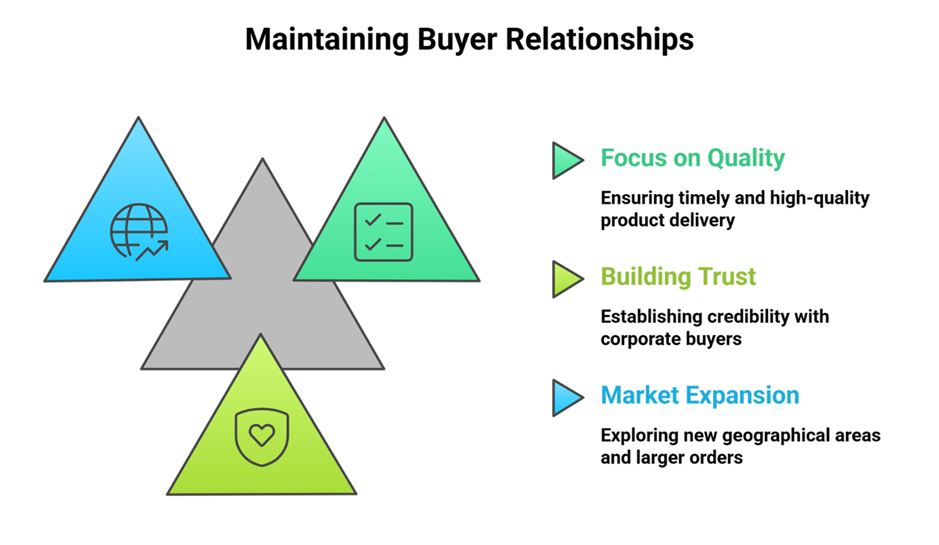

Protect Relationships with Buyers

When you use these Advantages of Invoice Discounting for SMEs, you do not need to chase your buyers again and again for payment. The finance partner handles the funding side, and you can keep your focus on:

- Quality and timely delivery

- Building trust with large corporate buyers

- Expanding to new markets and bigger ticket orders

This is very important for SMEs in India that supply to large companies and want to look professional and stable.

Why Choose Growmax Fintech for Invoice Discounting for SMEs?

Growmax Fintech understands the daily cash flow challenges of Indian SMEs and MSMEs that face delayed payments from buyers. With tech-driven processes, quick assessments, and access to multiple invoice funding companies, Growmax makes it easy to enjoy the real Advantages of Invoice Discounting for SMEs and keep your business running smoothly.

Clear introduces invoice discounting for SMEs to improve cash flow. The solution supports faster payments and smoother operations. If you are ready to unlock cash from your pending invoices and grow faster, visit Growmax Fintech today and request a call back from the team.