In India, Small and Medium Enterprises (SMEs) are often the backbone of the economy, yet they frequently face cash flow issues that hinder their growth. One of the most effective financial solutions available is invoice discounting, a process that allows SMEs to access immediate working capital by leveraging unpaid invoices. For businesses that don’t have the luxury of offering collateral, invoice discounting offers a lifeline.in 2026, several options are available to ensure that best invoice discounting for SMEs in India remains accessible to businesses without the need for collateral.

What is Invoice Discounting?

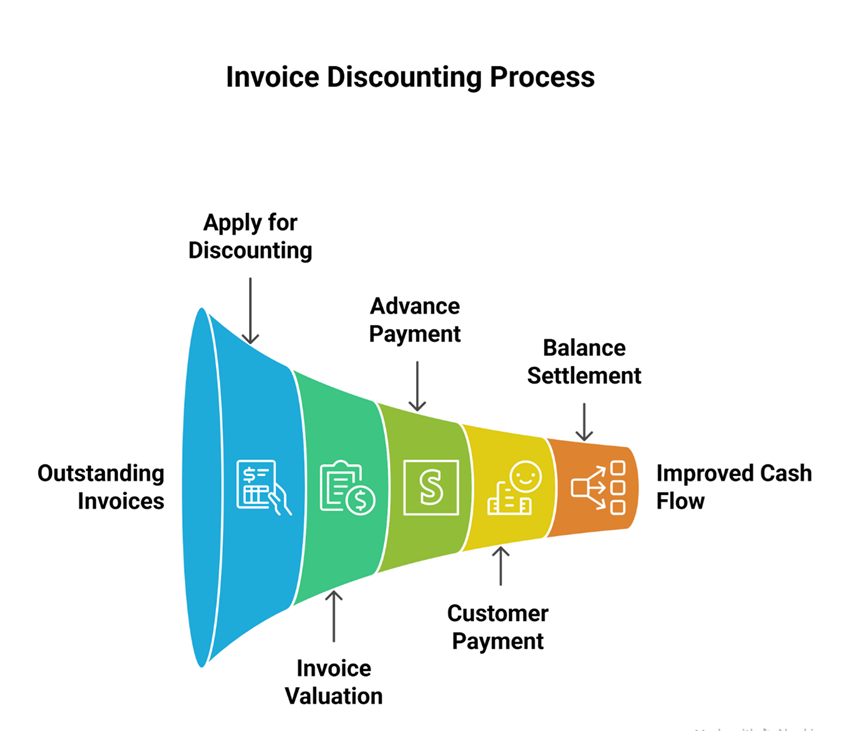

Invoice discounting is a form of financing where SMEs can get an advance against their outstanding invoices. Rather than waiting for clients to pay, businesses can access the funds they need immediately. The finance provider, typically a bank or financial institution, provides a percentage of the invoice value upfront. This method helps businesses manage day-to-day operations without being dependent on slow-paying customers.

Best Invoice Discounting for SMEs in India: Key Options

There are several invoice discounting options for SMEs in India in 2026, each with unique benefits. These are a few of the most dependable choices:

- Traditional Banks: Banks like HDFC, ICICI, and SBI offer invoice discounting services to businesses with a solid track record. These services often require proof of financial health but are ideal for those who have a strong business history.

- Fintech Lenders:Fintech companies like Growmax Fintech offer flexible and faster invoice discounting solutions. With minimal paperwork and a quicker approval process, these platforms allow SMEs to access working capital without the need for collateral.

- Non-Banking Financial Companies (NBFCs): Many NBFCs have tailored products that cater specifically to SMEs looking for best invoice discounting for SMEs in India. These institutions tend to be more flexible in their requirements, making them ideal for businesses that do not have access to traditional bank loans.

- Peer-to-Peer Lending Platforms: P2P lending has also emerged as a popular way to access invoice discounting. With platforms such as Faircent and Lendbox, SMEs can borrow from a pool of individual lenders who are willing to offer funds based on the value of outstanding invoices.

Key Benefits of Invoice Discounting for SMEs

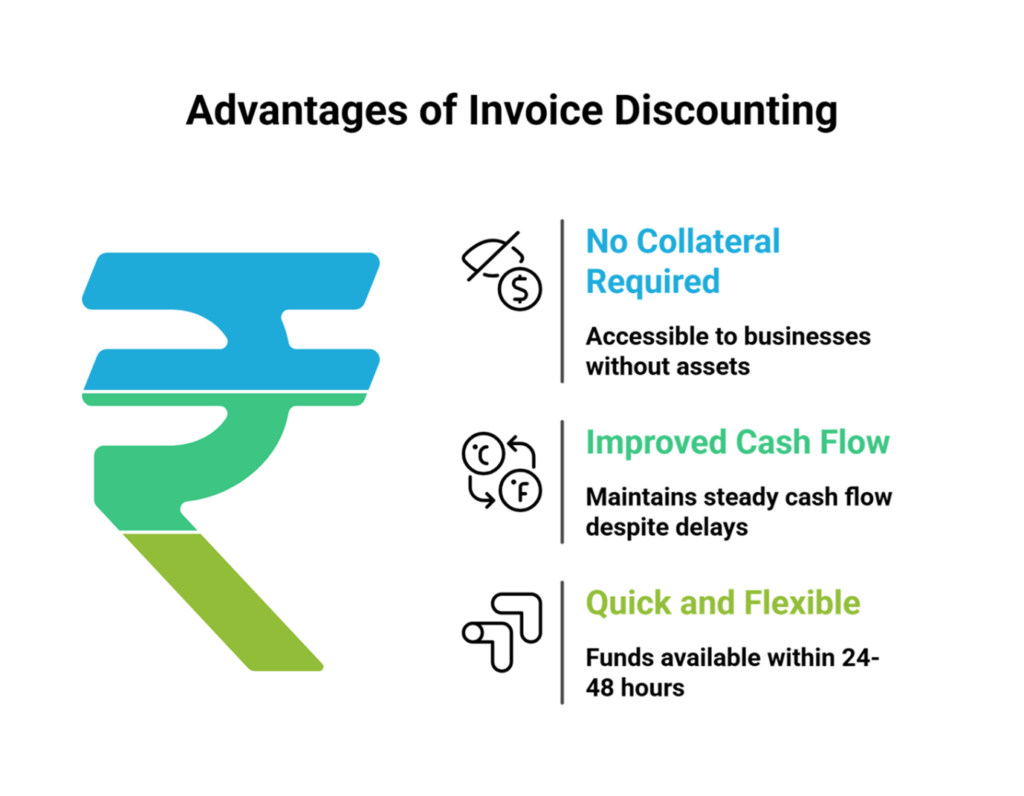

- No Collateral Required: One of the biggest advantages is that SMEs do not need to offer collateral, making it accessible to a larger segment of businesses.

- Improved Cash Flow: Invoice discounting helps businesses maintain a steady cash flow, even if clients delay payments.

- Quick and Flexible: Most providers offer quick processing, with the ability to get funds in as little as 24-48 hours.

How to Choose the Right Invoice Discounting Provider?

When looking for the best invoice discounting for SMEs in India, consider these factors:

- Interest Rates and Fees: Always compare rates across providers to find the best deal.

- Eligibility Criteria: Check the requirements for approval, such as the minimum turnover or number of invoices.

- Customer Service: Choose a provider with responsive customer support to handle any queries or issues.

In conclusion, invoice discounting is a valuable solution for SMEs in India that need fast access to capital without collateral. With several options available, it’s essential for businesses to compare the offerings of different providers to find the best fit for their needs.