Expanding into international markets is an exciting opportunity for SMEs, but managing finances for exports can be challenging. Export Finance Solutions for SMEs play a key role in helping businesses maintain smooth cash flow and cover operational costs. Growmax Fintech provides specialized solutions that allow exporters to focus on growth without financial stress and ensures every transaction is smooth and timely.

Why Export Finance is Crucial for SMEs

Many small and medium enterprises face delays in receiving payments from overseas buyers. During this waiting period, production and shipping costs continue, creating financial pressure.

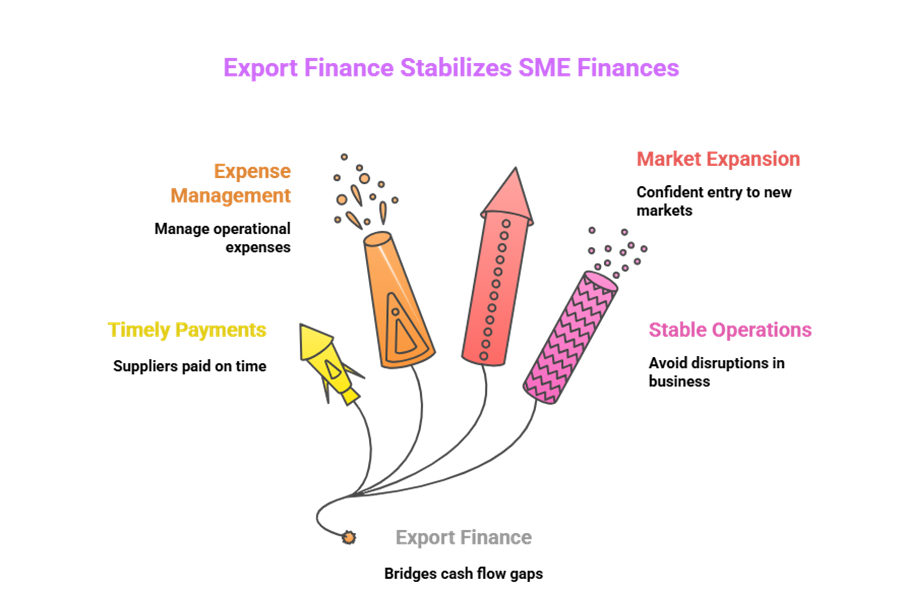

With the right Export Finance, businesses can:

- Bridge cash flow gaps

- Pay suppliers on time

- Manage operational expenses

- Expand into new markets confidently

- Avoid disruptions in daily business operations

Growmax Fintech ensures SMEs have access to funds when they need them, supporting continuous growth and operational stability. This makes international trade less stressful and allows businesses to plan for long-term growth.

Key Features of Export Finance Solutions for SMEs

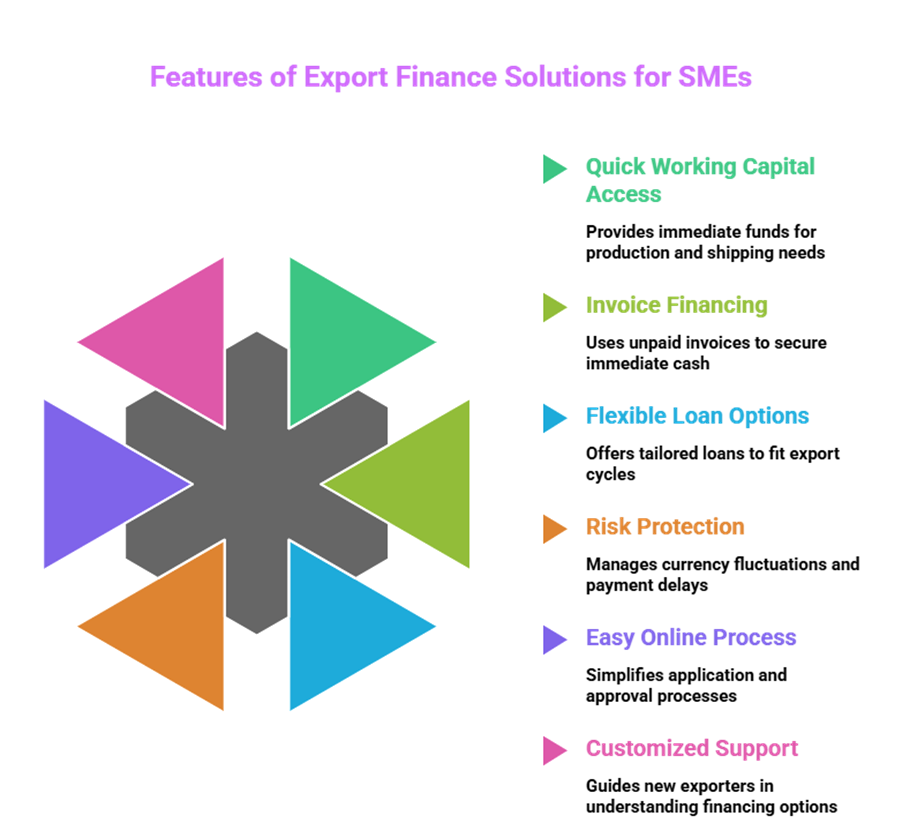

Growmax Fintech offers several services that help exporters manage finances effectively:

- Quick Working Capital Access – Get funds fast to meet production and shipping needs.

- Invoice Financing – Use unpaid invoices to secure immediate cash.

- Flexible Loan Options – Tailored loans that fit your export cycle and repayment capacity.

- Risk Protection – Manage currency fluctuations, delayed payments, and other trade risks.

- Easy Online Process – Apply online, get approvals quickly, and receive funds without complex paperwork.

- Customized Support – Guidance for new exporters to understand financing options and maximize benefits.

These features help SMEs focus on growing their business instead of worrying about financial delays.

How Growmax Fintech Empowers Exporters

Growmax Fintech combines technology and expertise to make financing simple, fast, and reliable. By offering Export Finance Solutions for SMEs, they help businesses:

- Strengthen relationships with overseas buyers

- Maintain credibility through timely payments

- Plan shipments and production without financial stress

- Improve competitiveness in international markets

- Gain confidence in managing larger orders

Achieve Sustainable Business Growth

With the right financial tools, SMEs can expand into global markets while keeping their operations smooth. Export Finance Solutions for SMEs provide stability, reduce risks, and support long-term growth. Partnering with Growmax Fintech allows exporters to focus on strategy and innovation rather than cash flow challenges.

Using these solutions, SMEs can:

- Access funding quickly when needed

- Cover costs for raw materials, shipping, and operations

- Reduce delays caused by late international payments

- Grow business globally with confidence

Growmax Fintech’s support ensures that every SME exporter has the resources to thrive in international trade, build stronger relationships with buyers, and achieve sustainable growth for years to come.