Running a growing business is exciting, but managing money can be challenging. Cash flow problems, unpaid invoices, or unexpected expenses can slow growth. That’s why working capital for growing enterprises is so important. Growmax Fintech makes managing money easy, helping businesses focus on what they do best growing.

What is working capital and why it matters

Working capital is the money a business has to pay for day-to-day operations. It’s the difference between what a company owns (assets) and what it owes (liabilities).

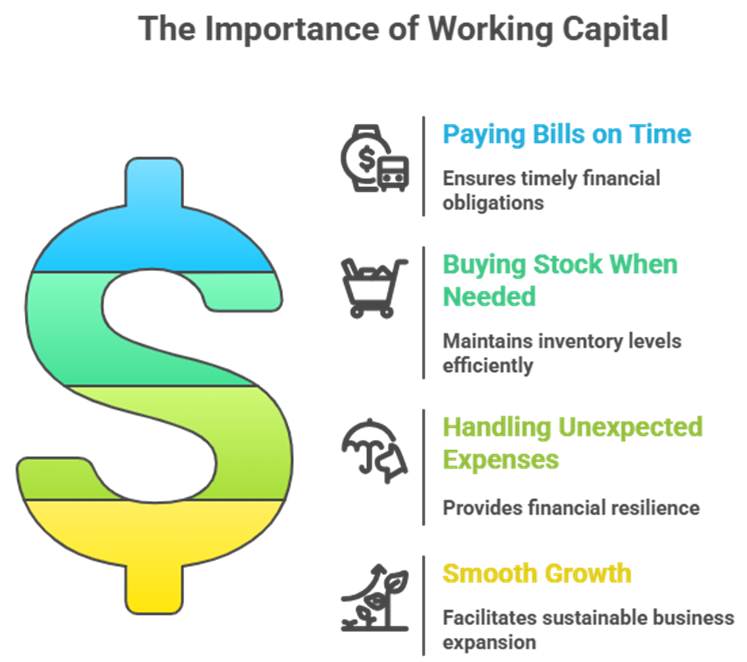

Good working capital management helps businesses:

- Pay bills on time

- Buy stock when needed

- Handle unexpected expenses

- Grow smoothly without money stress

For growing enterprises, even small cash flow problems can create big hurdles. Growmax Fintech offers tools that simplify money management and keep businesses running smoothly.

How Growmax Fintech helps

Growmax Fintech focuses on working capital for growing enterprises by offering simple and smart solutions:

- Invoice financing: Get money from unpaid invoices quickly.

- Supply chain financing: Pay suppliers on time without affecting cash flow.

- Short-term loans: Cover urgent expenses without long waits.

- Digital dashboard: Track money coming in and going out in real time.

These solutions give businesses faster access to funds, reduce stress, and make planning easier.

Benefits of using Growmax

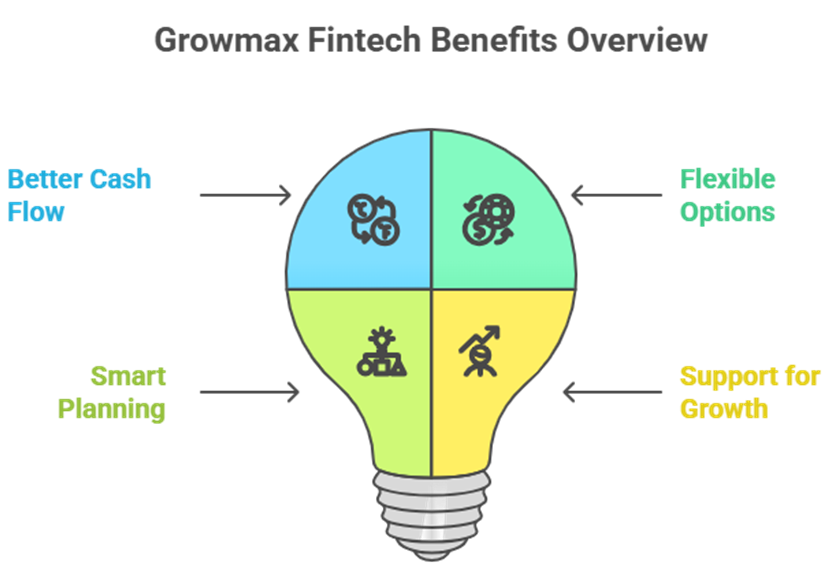

Using Growmax Fintech makes money management simple and effective. Some benefits include:

- Better Cash Flow: Pay bills and invest in growth without delays.

- Flexible Options: Choose solutions that fit your business needs.

- Smart Planning: Use real-time insights to make better decisions.

- Support for Growth: Focus on expanding your business confidently.

With the right working capital in place, businesses can focus on growth instead of worrying about money.

Common challenges and solutions

Even with good tools, businesses may face challenges like delayed payments or unexpected costs. Growmax helps by:

- Sending automatic reminders for unpaid invoices

- Offering easy-to-read dashboards to track cash flow

- Predicting future cash needs for smoother planning

These tools make it easier for growing enterprises to manage money smartly and avoid surprises.

The future of working capital

The world of finance is changing fast. Digital solutions from fintech companies like Growmax make it easier than ever for businesses to manage working capital. With faster access to funds, clear insights, and smarter planning, growing enterprises can:

- Save time and reduce stress

- Avoid cash flow problems

- Focus on growing their business

Why Growmax matters

Managing working capital for growing enterprises doesn’t have to be complicated. Growmax Fintech makes it simple, giving businesses the tools they need to stay on top of money matters, grow confidently, and succeed in a competitive market.