Operating a small or medium-sized enterprise (SME) often means facing cash flow challenges. Numerous businesses turn to invoice discounting as a quick way to unlock working capital. While this solution can be very effective, several common mistakes SMEs make in invoice discounting reduce the benefits and may even create new problems. Understanding the mistakes and learning how to avoid them can help SMEs use invoice discounting wisely and keep their finances strong.

Why SMEs prefer invoice discounting

Invoice discounting allows businesses to get money quickly by selling unpaid invoices to a financier. It helps businesses fund day-to-day expenses and settle suppliers without having to wait 30 to 90 days for the collection of money from customers. It is quick, adaptable, and in many cases is more easily obtained than a traditional loan.

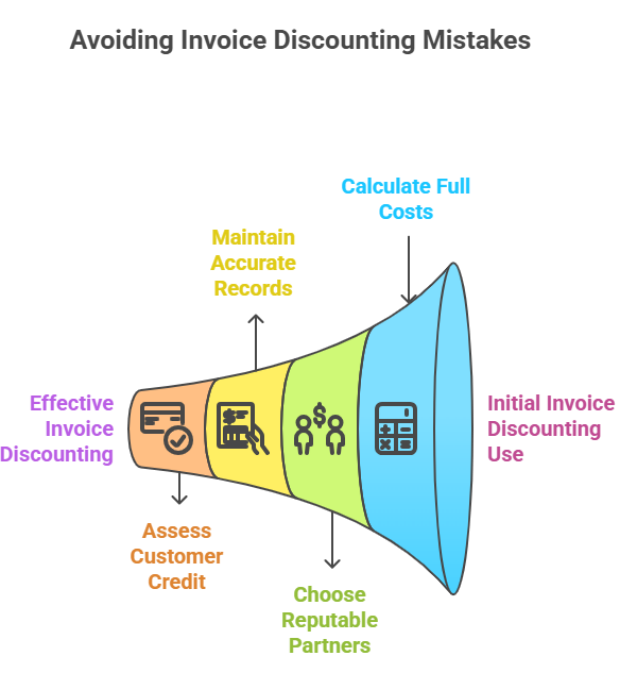

Common mistakes SMEs make in invoice discounting

Many SMEs start using invoice discounting without thinking about the risks. Let’s look at some of the most common errors and simple tips to avoid them.

Ignoring the real cost of finance

One of the biggest errors is not calculating the full cost. Some SMEs only look at the cash they receive and forget about hidden charges.

What to do instead:

- Compare the price quotations by different suppliers.

- Consider the processing fee, payment for late fines, and the renewal fee.

- Make sure the total cost is lower than the benefits.

Relying too much on invoice discounting

Some businesses use invoice discounting for almost every transaction. This brings about dependency and defeats long-term financial planning. Excess use is one of the common mistakes SMEs make in invoice discounting, because it turns a helpful tool into a crutch.

Improved method:

- It can be utilized in volume or overdue billing.

- Build an emergency fund to reduce complete dependence.

- Treat it as a tool, not a permanent solution.

Choosing the wrong finance partner

Not all financiers are transparent. Some have unclear terms, while others delay payments.

How to avoid this mistake:

- Check the provider’s reputation.

- seek the experience of other SMEs.

- Always read the terms and conditions carefully.

Poor record keeping

Neglecting proper records is another mistake. Missing or incorrect invoices can delay approval.

Tips for improvement:

- Store copies of invoices digitally.

- Double-check details before submitting.

- Train staff to follow simple, consistent practices.

Ignoring customer credit history

Some SMEs discount invoices from customers with poor payment records. If the customer doesn’t pay, the SME may face losses.

Smart strategy:

- Verify the payment records of the customers.

- Discount only invoices from reliable buyers.

- Spread risk across different customers.

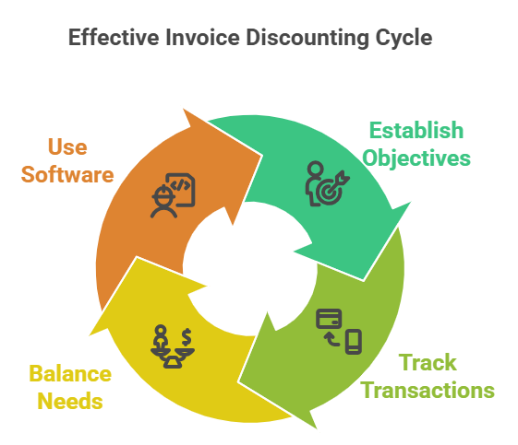

How to use invoice discounting effectively

To make invoice discounting work well for your SME:

- Establish clear financial objectives.

- Follow each transaction.

- Balance short-term needs with long-term growth.

- Use simple software tools for invoice management.

When used correctly, invoice discounting can improve cash flow and give SMEs a competitive edge.

Building a stronger future with better finance choices

Cash flow gaps are common for SMEs, but they don’t have to stop growth. By being aware of the common mistakes SMEs make in invoice discounting, business owners can reduce risks. Choosing the right partner, keeping accurate records, and checking customer credit are simple but powerful steps.

Invoice discounting is not just about fast money it’s about financial discipline and gradual development. SMEs that avoid these mistakes will develop better, more stable businesses.