In today’s fast-moving digital economy, small businesses need more than just passion and hard work to succeed. They require smart, scalable financial tools that can help them grow efficiently and sustainably. That’s where Smart lending & financing Tools play a vital role—and why platforms like Growmax Fintech are transforming the game for entrepreneurs everywhere.

The Evolving Needs of Small Businesses

Small businesses form the backbone of most economies. Yet, many face daily challenges like limited access to credit, time-consuming paperwork, and outdated loan systems. These issues can slow growth or even halt expansion altogether.

Traditional financial institutions often overlook startups and micro-enterprises due to perceived risks. But the reality is, small businesses are eager for innovative tools that allow them to manage lending and financing more easily.

This gap has created an opportunity for agile fintech companies like Growmax Fintech, which specialize in modern solutions that simplify borrowing, reduce costs, and increase accessibility.

Smart lending Tools for Modern Entrepreneurs

Why smart lending tools matter in small business lending

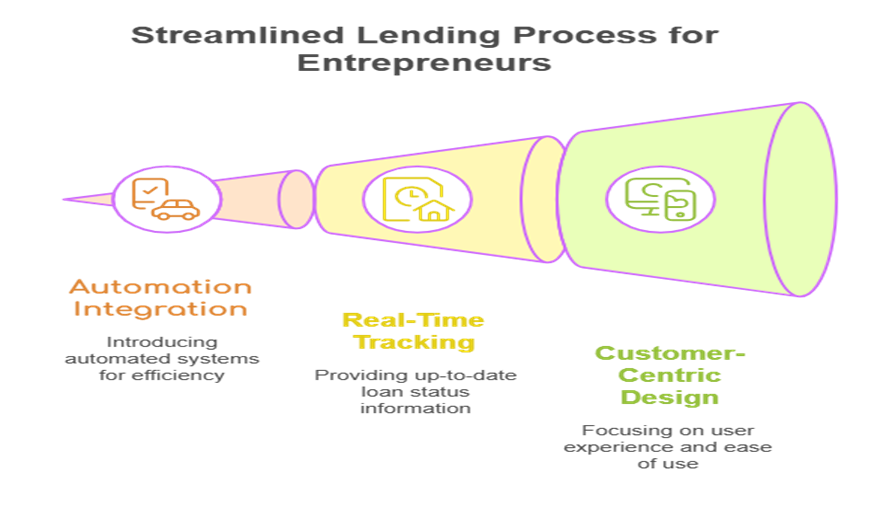

- Modern lending solutions go beyond basic loan approvals. They integrate automation, analytics, and customer-centric design to deliver a seamless experience. For small businesses, this means faster loan processing, fewer errors, and better financial decision-making.

- Growmax Fintech offers an ecosystem tailored to entrepreneurs. From automated credit checks to digital document uploads, real time loan tracking, these smart tools make borrowing intuitive and stress-free.

- By addressing bottlenecks in the traditional lending cycle, Growmax helps small businesses secure funding when it matters most—without jumping through hoops or getting buried in red tape.

Features That Set Growmax Fintech Apart

Growmax Fintech combines robust technology with a deep understanding of small business needs. Its platform is designed to be user-friendly, secure, and flexible—ideal for companies at any stage of growth.

Key features include:

- Approving loans automatically using AI-driven risk assessmentsTracking loan performance in real time with intuitive dashboards

- Integrating seamlessly with accounting software

- Supporting users across mobile, chat, and web platforms

These features not only improve efficiency but also foster trust and transparency—two critical components in the lending relationship.

Benefits of Embracing Digital Financing Solutions

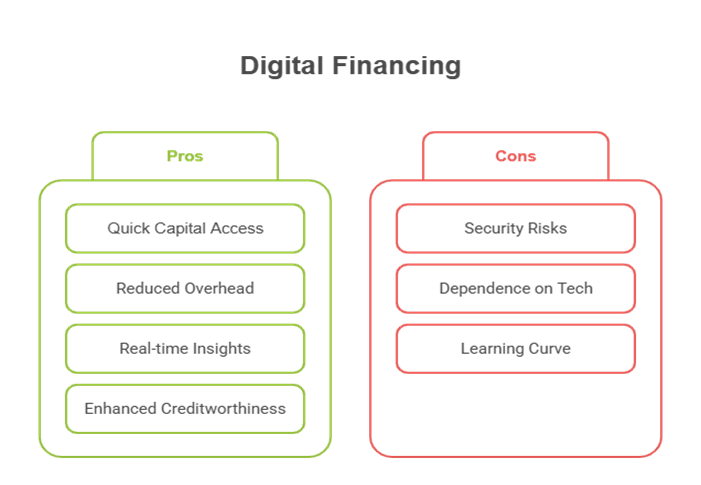

The benefits of using smart lending and financing tools go far beyond convenience. By adopting a platform like Growmax Fintech, businesses can

- Access capital more quickly to seize growth opportunities

- Reduce operational overhead by eliminating manual tasks

- Improve financial forecasting with real-time data insights

- Enhance their creditworthiness through responsible loan management

Time is one of the most limited resources for small business owners. Automating financial processes allows them to focus on what truly matters—growing their company, serving customers, and building a brand that lasts.

Empowering the Future of Smart lending and financing Tools

Growmax Fintech’s mission is centered on empowering small businesses through digital innovation. By removing traditional barriers and rethinking financial access, the platform has positioned itself as a trusted partner in the Smart lending and financing Tools space.

Entrepreneurs no longer need to feel constrained by outdated systems or limited by rigid banking practices. With Growmax Fintech, they have a reliable, scalable, and smart solution that evolves with their needs.

Conclusion

Growmax Fintech is more than a platform — it’s a catalyst for change in the way small businesses manage lending and financing. By offering smart, automated tools, it simplifies the path to funding and fosters sustainable growth. As Smart lending and financing Tools continue to evolve, Growmax is leading the charge, helping entrepreneurs turn ambition into achievement.